The Q1 2025 Private Capital Activity Report, produced by Stears Information in partnership with the East Africa Venture Capital Association (EAVCA), reveals significant insights into East Africa’s investment landscape.

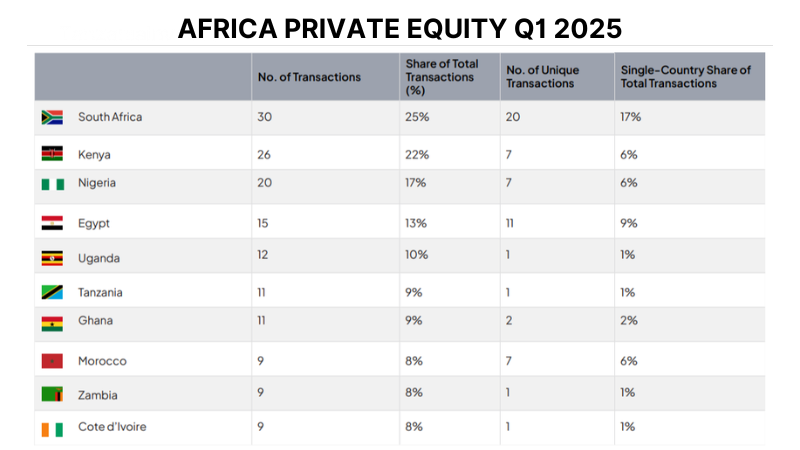

The report indicates that Tanzania attracted only 11 transactions, accounting for 9% of total deals in East Africa. This positions the country behind Kenya, which dominated with 72% of the region’s transactions.

Key Findings:

- Capital Distribution Challenges: The report emphasizes that Tanzania, along with Uganda and Rwanda, faces a “capital drought” for early-stage ventures. This is attributed to limited early-stage support and a reliance on a few core sectors, primarily energy and fintech.

- Investment Opportunities: There is a growing recognition of the need for targeted capital mobilization in underserved markets. Sectors such as renewable energy in Tanzania present significant opportunities for investors looking to diversify their portfolios beyond the traditional sectors.

- Local Institutional Capital: The report notes a persistent bottleneck in the investment ecosystem due to the lack of local Limited Partner (LP) participation in fundraising. In Tanzania, as in other East African countries, local institutional capital remains underutilized, with pension funds and insurers slow to engage in private equity investments.

- Sectoral Trends: The energy and healthcare sectors are highlighted as areas of potential growth. Mobilizing local capital could stabilize fund structures and unlock investments in high-impact sectors, which are crucial for Tanzania’s economic development.

- Comparative Performance: While Tanzania’s transaction volume is modest compared to Kenya, the report suggests that with strategic investments and improved local capital participation, the country could enhance its attractiveness to investors.

In conclusion, while Tanzania’s current investment landscape shows room for improvement, the potential for growth in sectors like renewable energy and healthcare, coupled with increased local capital participation, could pave the way for a more balanced and robust investment environment.