Private Equity

Private Equity Investments in Tanzania

Over the period 2013-2023, Tanzania has attracted approximately $600 million in private equity (PE) deal values, according to data from The East Africa Venture Capital Association (EAVCA).

Over the period 2013-2023, Tanzania has attracted approximately $600 million in private equity (PE) deal values, according to data from The East Africa Venture Capital Association (EAVCA).

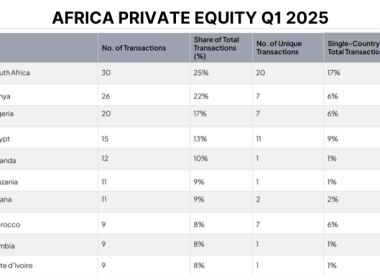

The Q1 2025 Stears Private Capital in Africa Report indicated that Tanzania accounted for just 11 private equity transactions during that quarter.

This volume represented 9% of the total deals recorded across East Africa for Q1 2025. Kenya accounted for 72% of transactions in the region during the same period.

The report noted that in Uganda, Tanzania, and Rwanda, early growth-stage companies face difficulties raising capital, particularly outside the energy and fintech sectors.

Statista projects that the total private equity deal value in Tanzania will reach US$4.99 million in 2025.

It forecasts an average deal size of US$1.68 million in Tanzania for 2025 and anticipates approximately 2.97 deals during the year.

For comparison, Statista data shows the highest global deal value projection for 2025 is in the United States, at US$640.67 billion.

The Stears report identifies the absence of local Limited Partner (LP) participation in General Partner (GP) fundraising as a persistent bottleneck in the regional investment ecosystem. Most East African investors rely on international LPs. Local institutional capital, such as from pension funds and insurers, shows slow entry into this asset class.

Combined pension and insurance assets in Kenya, Uganda, Tanzania, and Rwanda surpass $25 billion. However, local allocations to private capital remain negligible.

Kenya’s pension sector, controlling over $13 billion, allocates less than 1% to private equity, below the 10% regulatory ceiling. The report indicates similar gaps exist in Uganda and Tanzania, citing risk appetite, regulatory clarity, and pipeline visibility as barriers.