The Bank of Tanzania (BOT) released its Monthly Economic Review-January 2025, which covers key macroeconomic indicators for the year ending December 2024.

Table of Contents

GDP Growth

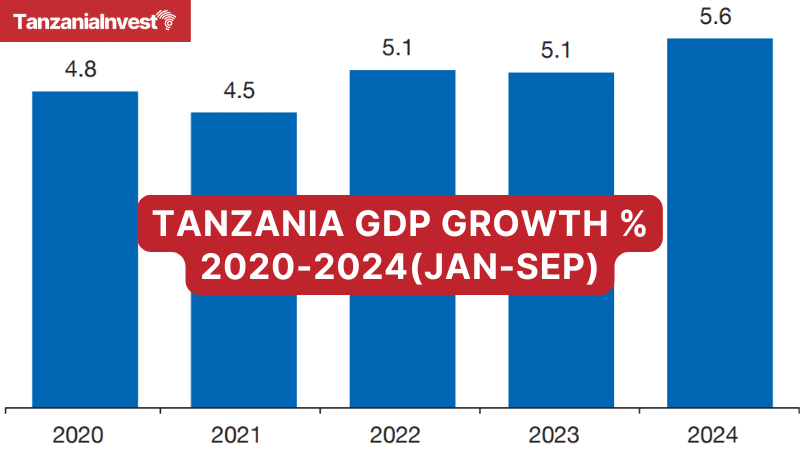

The economy maintained robust performance in 2024, growing at an average of 5.6% in the three quarters of 2024.

Growth in the third quarter was 5.9%, compared to 5.6% in the corresponding quarter in 2023.

Activities that contributed to this growth include agriculture, financial and insurance services, construction, and mining and quarrying.

The Bank of Tanzania projects strong growth in the fourth quarter, with a likelihood of attaining the projected growth of 5.4% in 2024.

The outlook is linked to good performance in agriculture—supported by favorable weather, adequate supply of inputs and their efficient utilization as well as increases in exports, and public and private investments.

Inflation

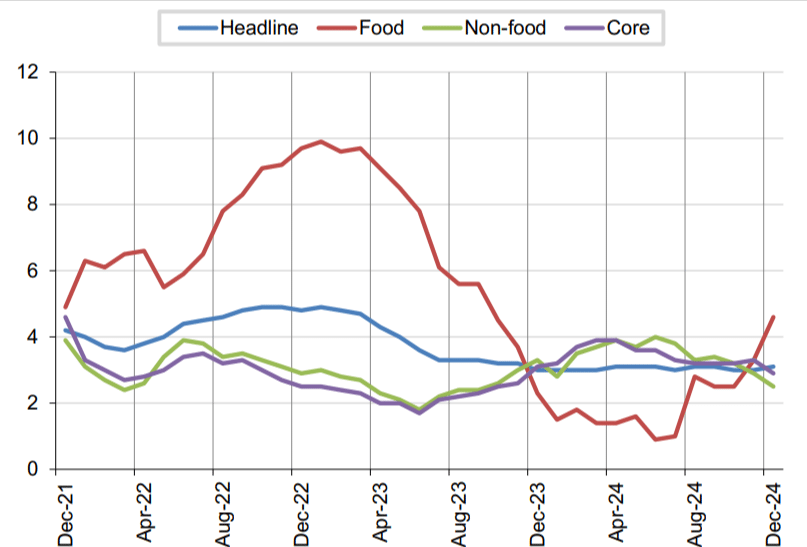

Inflation remained stable throughout 2024, averaging 3%, down from 3.8% in 2023—below the medium-term target of 5% and within EAC and SADC convergence criteria.

In December 2024, headline inflation was 3.1%, compared to 3% in December 2023.

The outturn was largely on account of stability in energy, fuel, and utilities inflation and moderation of service inflation.

Energy, fuel, and utilities inflation slowed to 5.3% in December 2024 from 5.7% in November 2024, attributed to moderation in diesel and petrol prices.

Core inflation remained stable, reflecting continued moderation of underlying inflationary pressures from unprocessed food and fuel.

Food inflation accelerated to 4.8% in December 2024, from 3.3% in November, primarily due to heightened seasonal demand associated with end-of-the-year festivals.

The upward price movement was observed in key staple foods such as maize, rice, and beans.

Overall, the food supply remained adequate. The National Food Reserve Agency (NFRA) held 677,115 tonnes of maize and paddy in December 2024, down from 702,502 tonnes in November 2024, following a release of 26,459 tonnes of maize to traders.

The stock was above the level recorded in December 2023 by 428,833 tonnes.

Monetary Policy

In December 2024, the Bank of Tanzania continued to implement monetary policy to attain its objectives of price stability while supporting economic growth.

The aim was to ensure adequate liquidity by aligning the 7-day Interbank Cash Market (IBCM) rate within a corridor of +/-200 basis points around the Central Bank Rate (CBR), which was set at 6% for the quarter ending December 2024.

During the month, shilling liquidity in the banks increased to the desired levels.

The 7-day IBCM rate averaged 7.55%, improving from the preceding month’s rate of 8.29% and remaining within the CBR corridor.

This was in response to the Bank’s decision to increase the amount of liquidity injection through repurchase agreements (reverse repos) and the Gold Purchase Program.

During the month, reverse repos sold amounted to TZS 3,768.9 billion, compared with TZS 2,578.5 billion traded in November 2024.

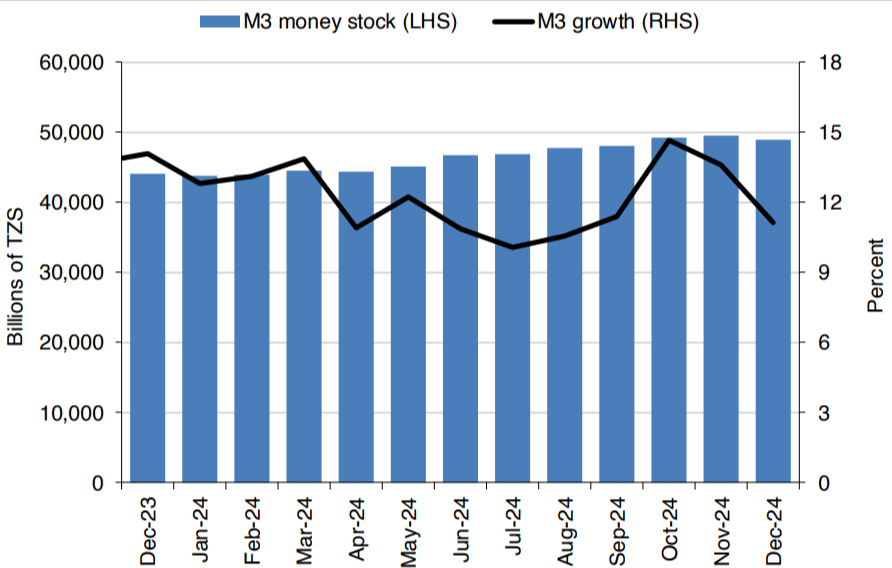

Extended broad money supply (M3) grew by 11.1%, compared with 13.6% in the previous month and 14.1% in December 2023, largely driven by credit to the private sector.

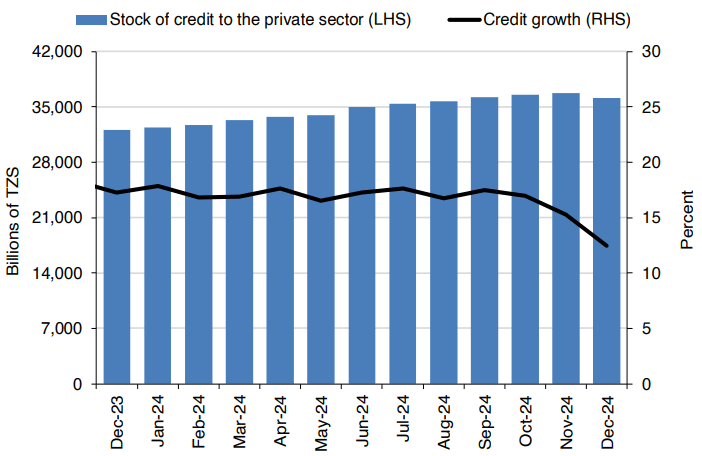

Credit to Private Sector

Credit to the private sector grew by 12.4%, in line with the thrust of monetary policy.

Credit to the agriculture sector recorded the highest growth at 41%, driven by increased demand following bumper crop harvests.

This was followed by credit expansion in the manufacturing sector at 16.3% and personal loans at 14.7%.

In terms of sectoral credit distribution, personal loans remained the largest recipient, accounting for 37.6% of total credit, reflecting sustained demand for consumer financing.

Trade activities and agriculture followed, receiving 12.7% and 12.6%, respectively.

Interest Rates

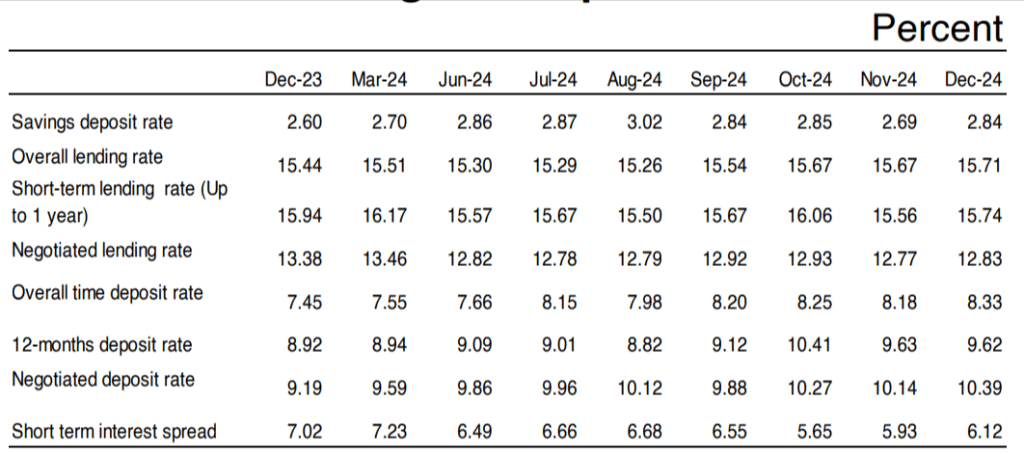

During the month, interest rates charged on loans and those offered on deposits varied.

The overall lending rate declined to 15.17% from 15.67% in the preceding month, while negotiated lending rates increased to 12.83% from 12.77% in November 2024.

The overall deposit rates increased to 8.33% from 8.18%.

Likewise, the negotiated deposit rate increased to 10.39% from 10.14%.

The spread between short-term lending and deposit interest rates narrowed to 6.12 percentage points from 7.02 percentage points recorded in a similar period in 2023.

Financial Markets

Government Securities Market

In December 2024, the Bank of Tanzania conducted two Treasury bill auctions with a combined tender size of TZS 252.8 billion, primarily to cater to government budgetary needs.

Total bids received amounted to TZS 239.5 billion, of which TZS 217.8 billion were successful.

The weighted average yield increased to 12.86% from 12.68% in the preceding month.

During the same month, the Bank conducted two Treasury bond auctions for 10-year and 20-year bonds to support government financing.

The 10-year bond was canceled due to undersubscription, while the 20-year bond saw strong demand, with total bids amounting to TZS 244.9 billion, of which TZS 211.9 billion were successful.

The weighted average yield to maturity for the 20-year Treasury bond rose to 15.71% from 15.64%.

Interbank Cash Market

The Interbank Cash Market (IBCM) continued to play a vital role in facilitating the distribution of shilling liquidity among banks.

In December 2024, total transactions in the market amounted to TZS 1,616.8 billion, slightly lower than the TZS 1,650 billion recorded in the preceding month.

Overnight transactions accounted for 12% of total market turnover, while 7-day transactions represented 43.9% of overall IBCM activity.

The share of overnight transactions continued to decline, reflecting banks’ preference for longer-tenure placements, in line with improved liquidity conditions.

Consequently, the overall IBCM interest rate decreased to 7.41%, down from 8.06% in November 2024.

Interbank Foreign Exchange Market

Foreign exchange liquidity improved significantly in December 2024, owing to the prudent implementation of monetary policy, a significant seasonal increase in foreign exchange earnings from exports of cashew nuts and tobacco, and receipts from the mining sector and tourism activities.

This development was further supported by improvements in global economic conditions, particularly interest rate cuts by central banks in advanced economies and moderate commodity prices in the world market.

Consequently, activity in the interbank foreign exchange market (IFEM) increased significantly.

Transactions in IFEM amounted to USD 95.7 million in December 2024, higher than the USD 17.1 million transacted in a similar period in 2023.

The Bank of Tanzania appeared on both sides of the market during the month, purchasing USD 0.5 million and selling USD 2 million.

The nominal exchange rate appreciated significantly, reversing the depreciation trend recorded in previous months since December 2021.

In December 2024, the shilling traded at an average of TZS 2,420.84 per US dollar compared to TZS 2,659.03 per US dollar in November 2024, equivalent to a monthly appreciation of 9.3%.

On an annual basis, the shilling appreciated by 3.8%, compared to a depreciation of 6.3% recorded in the previous month.

Government Budgetary Operations

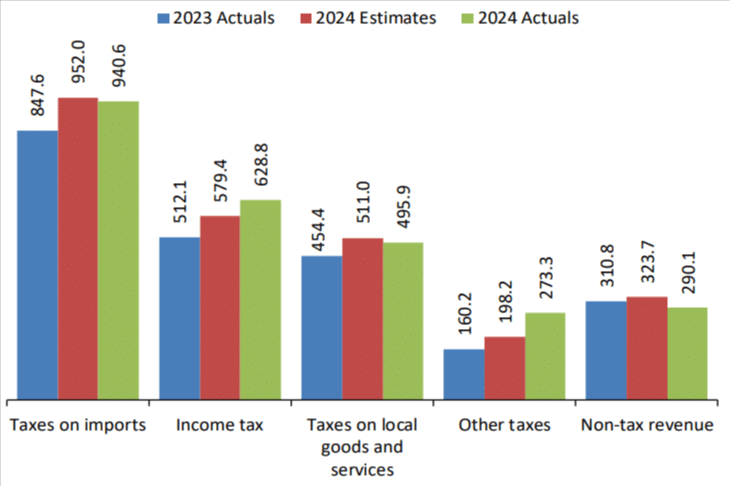

Domestic revenue collection for November 2024 amounted to TZS 2,737.6 billion, surpassing the target for the month by 2.4%.

Central government collection, which accounted for 96% of the total collections, amounted to TZS 2,628.6 billion, exceeding the estimates by 2.5%.

The performance was largely attributed to improved tax compliance and enhanced revenue mobilization efforts.

Tax revenue outperformed the target by 4.4%, reaching TZS 2,338.5 billion, with the outturn largely driven by income tax and other tax categories.

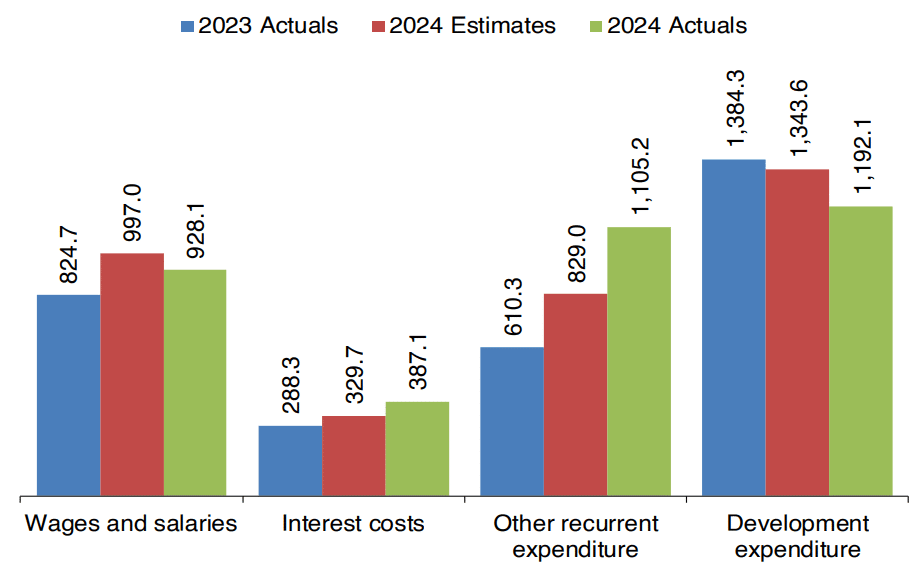

The Government continued to align its expenditure with available resources.

In November 2024, total government expenditure amounted to TZS 3,612.4 billion, of which TZS 2,420.3 billion was allocated for recurrent expenditure.

TZS 1,192.1 billion was directed toward supporting investments in infrastructure, social programs, and other development activities.

Debt Developments

The national debt stock recorded a monthly increase of 0.5%, reaching USD 46,562.1 million at the end of December 2024, with 70.7% of this amount attributed to external debt.

External Debt

The stock of external debt decreased by 1.8% to USD 32,928.4 million at the end of December 2024, compared with the level recorded at the end of the preceding month.

Disbursed external loans during the month amounted to USD 376.8 million, primarily to the central government, while external debt service totaled USD 185.4 million, consisting of USD 111.2 million for principal repayment and the remaining balance for interest payments.

The central government continued to hold a significant portion of the external debt, accounting for 77.4%.

The composition of external debt by creditor remained consistent with the previous month and the corresponding period in 2023.

Transportation and telecommunications activities continued to receive the largest share of disbursed outstanding debt.

The currency composition of external debt remained unchanged, with the US dollar continuing to dominate.

Domestic Debt

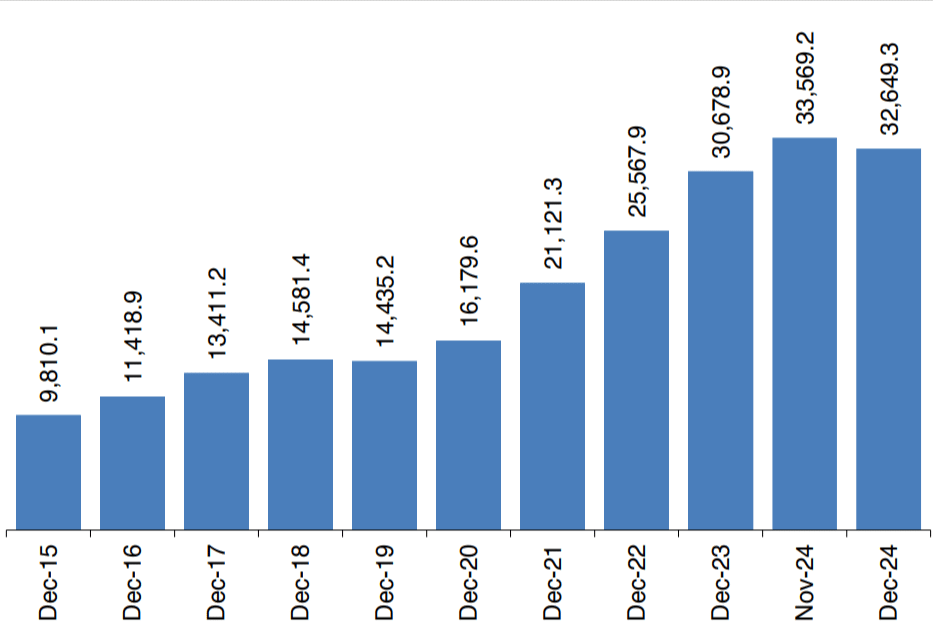

The domestic debt stock recorded a monthly decrease of TZS 919.9 billion, reaching TZS 32,649.3 billion at the end of December 2024.

The decrease was largely attributed to a reduction in the use of the overdraft facility by the Government, following an improvement in revenue collection during the month.

The debt portfolio remained predominantly composed of Treasury bonds, which accounted for 80.8% of the total.

Commercial banks and pension funds continued to be the Government’s primary domestic creditors.

During the reporting month, government securities issued for financing purposes amounted to TZS 436.6 billion, comprising TZS 224.8 billion in Treasury bonds and the balance in Treasury bills.

Domestic debt service for the month amounted to TZS 515.5 billion, including TZS 231.6 billion for principal repayment and TZS 284 billion for interest payments.

State-Owned Enterprises’ (SOEs) outstanding domestic debt at the end of December 2024 amounted to TZS 74.1 billion, lower than the position at the end of the preceding month by TZS 1.2 billion.

This decrease was driven by DAWASA and the Tanzania Railway Corporation.

The public debt remains sustainable in the medium to long term, as evidenced by the results of the debt sustainability analysis for 2023/24 conducted in October 2024.

In present value terms, public debt stood at 41.1% of GDP, below the maximum threshold of 55% set in the IMF/World Bank Debt Sustainability Framework and the EAC convergence criterion of 50%.

In nominal terms, the debt was 46% of GDP, remaining below the 60% threshold for SADC convergence criteria.

External Sector Performance

The external sector continued to improve, supported by favorable global and domestic economic conditions.

The current account deficit narrowed by 28.6% to USD 2,113.5 million in 2024, down from USD 2,958.3 million in 2023.

The improvement was driven by increased export earnings and a slowdown in imports.

In December 2024, foreign exchange reserves stood at USD 5,500.5 million, compared to USD 5,450.1 million in December 2023.

The reserves were sufficient to cover 4.5 months of projected imports of goods and services, aligning with both national and EAC benchmarks of 4 and 4.5 months, respectively.

Exports

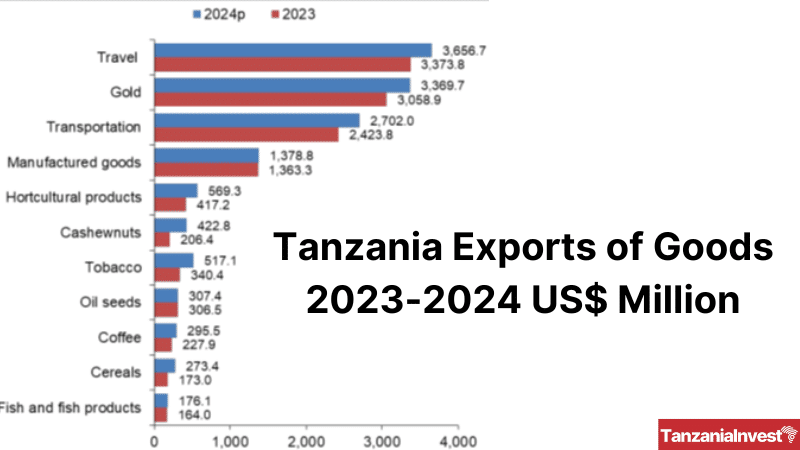

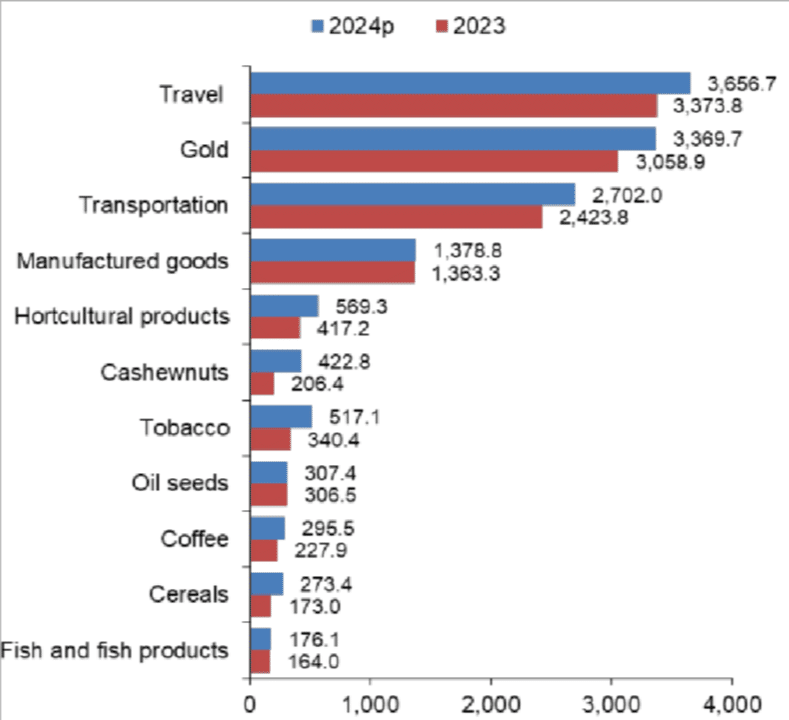

Exports of goods and services grew by 15.1% to USD 16,093.1 million in 2024, up from USD 13,980.3 million in December 2023.

This performance was driven by increased export earnings from minerals, agricultural products, and services, mainly those associated with tourism and transportation.

Exports of goods reached USD 9,144.8 million, an increase of 18.8% from USD 7,696.6 million in 2023.

This growth was attributed to higher exports of gold, cashew nuts, tobacco, horticulture products, coffee, and fish and fish products.

Gold exports amounted to USD 3,369.7 million, accounting for 36.8% of total goods exports, driven mainly by price effects.

Exports of traditional commodities totaled USD 1,372.2 million, with cashew nuts, tobacco, and coffee contributing the most.

On a monthly basis, goods exports amounted to USD 847.6 million in December 2024, compared to USD 589.8 million in December 2023, driven by higher cashew nuts and gold exports.

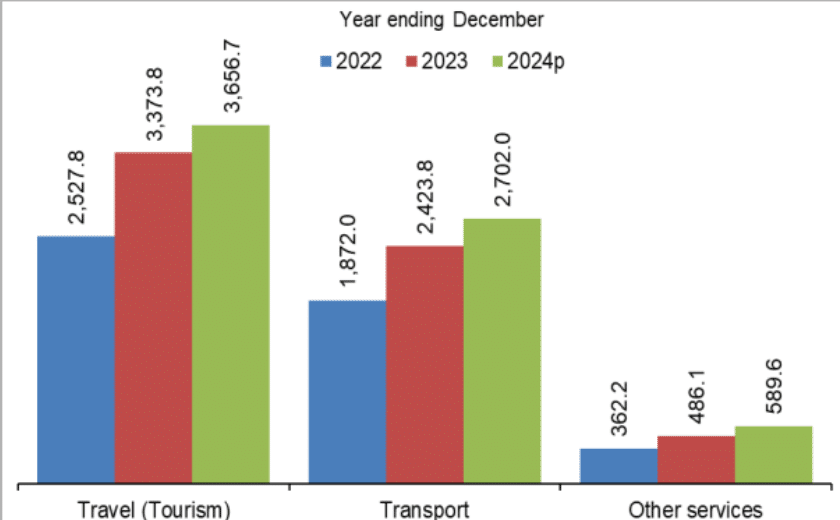

In 2024, service receipts increased by 10.6% to USD 6,948.2 million, up from USD 6,283.7 million in 2023, following higher receipts from tourism (travel) and transportation.

Travel receipts rose by 8.38% to USD 3,656.7 million, supported by an increase in international arrivals.

Imports

In 2024, imports of goods and services amounted to USD 16,789.9 million, up from USD 16,058.7 million in 2023.

Major contributors to this increase were industrial products, refined white petroleum products, and freight payments.

Imports of refined white petroleum products declined by 3.6% to USD 2,627.8 million from the amount reported in 2023, driven by moderation in global prices.

On a monthly basis, imports of goods rose by 10.7% to USD 1,430.2 million in December 2024, largely attributed to increased imports of industrial transport equipment and electrical machinery and equipment.

During the review period, service payments increased by 6% to USD 2,470.1 million, mainly due to freight payments, which accounted for 51.5% of total service payments.

The increase in service payments was consistent with a rise in goods imports.

Monthly service payments amounted to USD 261.6 million in December 2024, up from USD 186.7 million in December 2023.

The primary income account deficit was USD 1,893.4 million in 2024, compared with USD 1,536 million in 2023, attributable to higher interest payments.

Month-on-month, the primary income account deficit was USD 202.3 million, up from USD 163.1 million in December 2023.

The secondary income account surplus amounted to USD 476.6 million in 2024, compared to USD 656.1 million in 2023.

On a monthly basis, the secondary income account surplus was USD 35.1 million in December 2024, down from USD 98.5 million in December 2023.