The Bank of Tanzania (BoT) has released its Monthly Economic Review–September 2025, outlining Tanzania’s economic performance for the year ending August.

Output Performance

Economic activities continued to strengthen, driven mainly by mining, agriculture, construction, and manufacturing.

The Bank estimated the growth of the economy to be more than 6% in the third quarter of 2025, based on high-frequency economic indicators, such as credit to the private sector, export performance (including tourism), construction, and agricultural activities.

Inflation

Inflation remained well within the target range of 3-5%, consistent with the East African Community (EAC) and Southern African Development Community (SADC) convergence criteria of not more than 8% and 3-7%, respectively.

Specifically, the twelve-month headline (overall) inflation was 3.4% in August 2025, up from 3.3% in the preceding month.

The Bank projects inflation to remain low and stable, within the target range. The inflation outlook is bolstered by prudent monetary and fiscal policies, stable food supplies, and exchange rate stability. Projected moderate oil prices in the world are reinforcing these factors.

Unprocessed food continued to be the main contributor to inflation for the third month in a row, followed by core inflation and energy-related components.

Food inflation increased to 7.7% in August 2025 from 7.6% in July 2025, on account of an increase in prices of some staple and alternative food crops, notably rice and finger millet.

Core inflation also rose slightly to 2% in August 2025 from 1.9% in July 2025 but remained lower than recent historical levels.

The increase was mainly attributed to higher prices of household equipment such as electronics, car accessories, sports and games equipment, and non-alcoholic beverages.

Inflation for energy, fuel, and utilities increased to 2.6% in August 2025 from 1% in the preceding month but was lower than 11.2% in the corresponding month of 2024. The monthly increase was mainly attributed to a rise in the prices of charcoal and firewood.

The annual decline in energy inflation reflects the easing of global oil prices in the world market. Prices of petroleum products—including diesel and kerosene—continued to trend downward during the month.

Food stocks held by the National Food Reserve Agency (NFRA) remained reasonably high, even after releasing 2,594.2 tonnes of maize to traders and the World Food Programme.

The food stocks were augmented by procurement of 54,234.4 tonnes from Makambako, Songea, Sumbawanga, and Songwe.

Monetary Policy

The Bank continued to implement monetary policy to ensure the 7-day interbank interest rate moved close to the Central Bank Rate (CBR) of 5.75% during the third quarter of 2025, ranging from 3.75–7.75%.

The CBR was lowered from 6% in July 2025 by the Monetary Policy Committee (MPC) after an assessment indicated that the inflation outlook was well within the target and the risk to the forecast was low.

The low risk to the inflation forecast was due to adequate domestic food supply, a stable exchange rate, and moderate oil prices in the world market.

The implementation of monetary policy produced a satisfactory outcome.

Liquidity in the interbank market improved, and the 7-day interbank rate declined, approaching the CBR in some parts of the months.

This performance was mainly achieved through liquidity injection, full allotment, and fine-tuning reverse repo operations.

Consistent with the improvement in liquidity conditions, the extended broad money supply (M3) grew by 21% year-on-year in August 2025, compared with 19.9% in the preceding month.

Banks’ Credit to the Private Sector

Credit to the private sector, the main driver of money supply growth, rose by 16.2% compared with 15.9% in July 2025.

Agriculture continued to register the highest credit growth, expanding by 30.1%, followed by trade at 29.2%, and transport and communication at 18.8%.

In terms of credit distribution, personal loans—primarily directed toward financing micro, small, and medium-sized enterprises—remained dominant, accounting for 36% of total private sector credit.

Trade and agriculture followed, with respective shares of 14.2% and 13.2%.

Interest Rates

Lending and deposit interest rates remained broadly stable in August 2025.

The overall lending rate eased slightly to 15.07% from 15.16% in the preceding month.

By contrast, lending rates charged to prime customers (negotiated rates) increased slightly to 12.72%, compared with 12.56% in July 2025.

On the deposit side, the overall rate averaged 8.61%, slightly lower than 8.83% in the preceding month, while the negotiated deposit rate increased to 10.99% from 10.72% in July 2025.

The short-term interest rate spread of one-year lending and deposit rates narrowed to 5.66 percentage points from 6.68 percentage points recorded in the corresponding month of 2024.

Financial Markets

Government Securities Market

During the month under review, the Bank conducted two Treasury bill auctions with a total tender size of TZS 163.6 billion, mainly for financing government budgetary operations, with a small portion aimed at facilitating price discovery of short-term financial instruments.

Reflecting adequate liquidity in the market, the auctions attracted bids worth TZS 409.7 billion, of which TZS 162.9 billion were successful.

Consistently, the overall weighted average yield decreased to 6.83% from 8.13% recorded in the preceding month.

The Bank also conducted auctions for 15- and 25-year Treasury bonds, with tender sizes of TZS 213.1 billion and TZS 293.7 billion, respectively.

All auctions were significantly oversubscribed, indicating improved market liquidity and rising investor appetite for government securities driven by greater awareness.

Total bids reached TZS 2,256.4 billion, of which TZS 867.7 billion were accepted.

As a result, the weighted average yields declined to 13.91% for the 15-year bonds and 14.42% for the 25-year bonds.

Interbank Cash Market

The interbank cash market (IBCM) remained instrumental in supporting the transmission of monetary policy by facilitating the redistribution of shilling liquidity among banks.

In August 2025, market turnover amounted to TZS 2,374.5 billion, compared to TZS 3,746 billion in the preceding month.

Trading was dominated by 7-day transactions, which accounted for nearly 60% of total activity.

The IBCM interest rate eased to 6.48% from 7.35% in July 2025, largely reflecting the adequacy of liquidity, which kept interbank rates close to the Central Bank Rate (CBR).

Interbank Foreign Exchange Market

Liquidity conditions in the Interbank Foreign Exchange Market (IFEM) remained adequate in August 2025, supported by receipts from cash crops, tourism, and gold exports, alongside the easing of global oil prices.

During August, a total of USD 101.5 million in transactions was traded in the IFEM, compared to USD 162.5 million in July 2025, with banks accounting for 80.7% of the total transactions.

The Bank participated in the market in line with the Foreign Exchange Intervention Policy to reduce excess volatility, auctioning USD 19.5 million.

The Tanzanian shilling appreciated against the US dollar, trading at TZS 2,490.16 per USD, compared with TZS 2,666.79 per USD in the preceding month, and remained broadly stable against other major currencies.

On a year-on-year basis, the shilling appreciated by 7.6%, reversing a depreciation of 0.1% in the preceding month and 10.3% in the corresponding period in 2024.

Government Budgetary Operations

Provisional statistics indicate that government revenue, inclusive of collections by Local Government Authorities (LGAs), amounted to TZS 2,911.6 billion in July 2025, representing 103% of the monthly target.

Central government collections totalled TZS 2,592.7 billion, comprising TZS 2,345.8 billion in tax revenue and TZS 246.8 billion in non-tax revenue.

Notably, the income tax and import tax categories surpassed their respective targets, primarily attributable to the upgrading of the Customs Management System, strengthened tax compliance, and higher import volumes.

In July 2025, the Government upheld its commitment to fiscal consolidation by aligning expenditures with available resources, with total spending amounting to TZS 4,006.2 billion.

This comprised recurrent expenditure of TZS 2,371.8 billion and development expenditure of TZS 1,634.4 billion.

Debt Developments

The national debt stock at the end of August 2025 was USD 50,462.6 million, 2.8% higher than the stock at the end of the preceding month. Of the total debt stock, 70.1% was external debt.

External Debt

The stock of external debt, comprising both public and private obligations, increased by 0.6% from the level at the end of July 2025, reaching USD 35,389.3 million.

Of this amount, 80.8% was public debt, while the remainder was private sector debt.

External loans disbursed during the month under review amounted to USD 92 million, largely directed to the Government, while external debt service payments totalled USD 85.6 million, of which USD 52.6 million represented interest obligations.

Multilateral institutions remained the main creditors, accounting for 56.9% of the external debt stock, followed by commercial lenders.

The composition of beneficiaries of disbursed outstanding external debt remained broadly unchanged from the preceding month and corresponding period in 2024, with balance of payment and budget support accounting for the largest share, followed by social welfare and education-related activities.

Meanwhile, the US dollar continued to dominate the currency composition of external debt, followed by the euro.

Domestic Debt

Domestic debt stood at TZS 37,129.8 billion at the end of August 2025. This represents a monthly increase of 5%, mainly attributed to the issuance of government bonds.

Long-term instruments, particularly Treasury bonds, continued to dominate the domestic debt portfolio, with commercial banks and pension funds remaining the main domestic creditors of the Government.

In August 2025, the Government borrowed a total of TZS 1,644.1 billion from the domestic market to finance its budget.

Of this amount, TZS 1,480.7 billion was raised through government bonds and TZS 163.5 billion through Treasury bills.

Additionally, the Government allocated TZS 496.1 billion to service domestic debt, of which TZS 118.6 billion was used for principal repayments and TZS 377.5 billion for interest payments.

The position of outstanding domestic debt of selected State-Owned Enterprises (SOEs) at the end of August 2025 was a balance of TZS 83.3 billion, equivalent to a monthly decrease of 0.6%.

External Sector Performance

The external sector’s performance continued to strengthen, showcasing a resilient trade position despite ongoing trade tensions.

This performance was evident in the narrowing of the current account deficit to USD 2,022.2 million for the year ending August 2025, an improvement from USD 3,066.1 million in the corresponding period of 2024.

A more favourable trade balance, characterized by higher export growth relative to import bills, explains the improvement.

Foreign exchange reserves amounted to USD 6,393.8 million in August 2025, up from USD 5,379.7 million in August 2024.

The rise in reserves was sufficient to cover 5.2 months of projected imports, above the national and East African Community (EAC) regional benchmarks of 4.0 and 4.5%, respectively.

Exports

Export of goods and services registered an annual growth of 14.8% to USD 16,894.4 million in the year ending August 2025.

Export of goods amounted to USD 9,886.9 million, up by 22.7% from the year ending August 2024.

This development was driven by increased exports of gold, manufactured goods, cashew nuts, tobacco, and cereals.

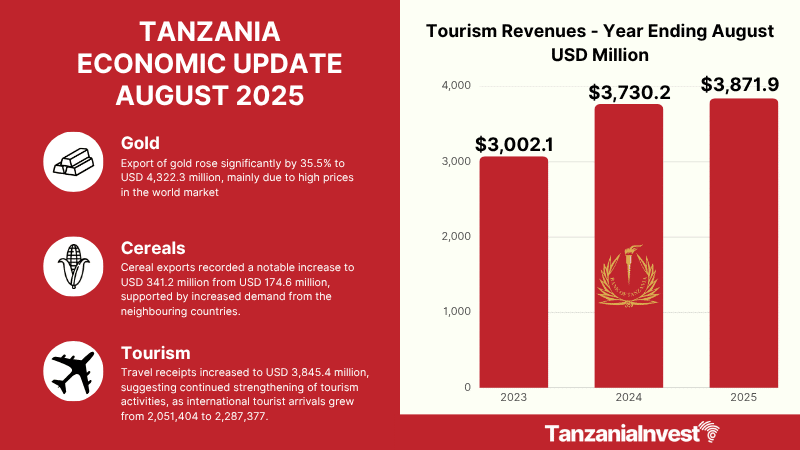

Exports of gold rose significantly by 35.5% to USD 4,322.3 million, mainly due to high prices in the world market.

Traditional exports improved to USD 1,411.7 million, a 28.3% increase, owing to strong exports of cashew nuts, tobacco, and coffee, supported by both price and volume effects.

Cereal exports recorded a notable increase to USD 341.2 million from USD 174.6 million, supported by increased demand from neighbouring countries.

On a monthly basis, exports of goods amounted to USD 1,024.8 million in August 2025, up from USD 922.4 million in August 2024, largely driven by gold and tobacco exports.

Service receipts amounted to USD 7,007.6 million for the year ending August 2025, an increase from USD 6,665.1 million in the same period of 2024.

Travel and transport receipts primarily explain this growth. Travel receipts increased to USD 3,845.4 million in the year ending August 2025, suggesting continued strengthening of tourism activities, as international tourist arrivals grew from 2,051,404 to 2,287,377.

Imports

The import of goods and services experienced a modest increase of 4.5%, reaching USD 17,422.3 million for the year ending August 2025.

The modest increase in imports was primarily attributed to a decline in imports of refined white petroleum products, which decreased by 11.4% to USD 2,513.7 million, following a reduction in global oil prices.

In contrast, imports of industrial supplies, transportation equipment, and spare parts and accessories increased, bolstered by the country’s industrialization efforts and ongoing infrastructure projects.

On a monthly basis, imports of goods amounted to USD 1,367.7 million in August 2025, a decrease from USD 1,459.9 million in August 2024, largely driven by reduced oil import bills.

Service payments amounted to USD 3,020.7 million, up by 19% from August 2024.

The increase was driven by higher freight payments, consistent with the increase in import bill.

On a monthly basis, service payments amounted to USD 281.8 million in August 2025, slightly down from USD 284.7 million in August 2024.

The primary income account deficit widened to USD 1,996.8 million, compared to USD 1,704.2 million in the same period in 2024, owing to increased payment of income on equity and interest abroad.

On a monthly basis, the primary account deficit amounted to USD 175.1 million in August 2025, up from USD 149 million in August 2024.

As for the secondary income account, the surplus amounted to USD 502.5 million, lower than USD 597 million in the corresponding period in 2024, mainly attributed to personal transfers.

On a monthly basis, the surplus amounted to USD 15.4 million in August 2025, down from USD 19 million in August 2024.