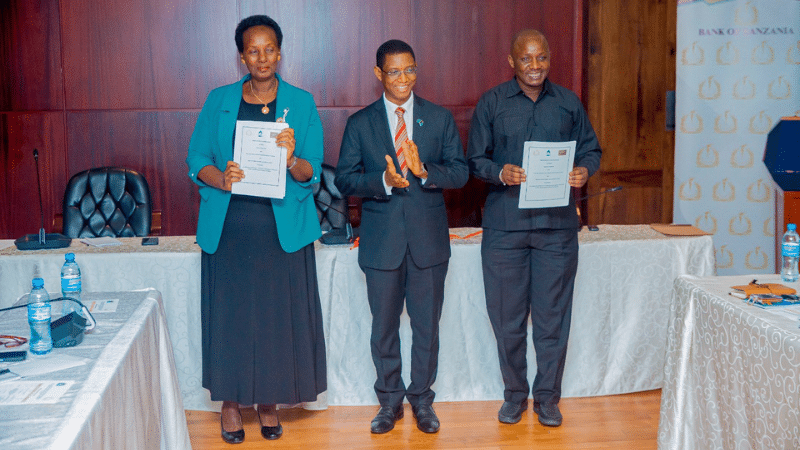

On 2 July 2025, the Bank of Tanzania (BoT) signed a Memorandum of Understanding (MoU) with the Tanzania Association of Microfinance Institutions (TAMFI) and the Tanzania Microfinance Union (TAMIU) to implement a new self-regulatory framework for Tier 2 microfinance institutions.

The agreement marks the official rollout of a regulatory framework initially agreed upon in March 2025.

It aims to formalise oversight and improve the operating environment for second-tier microfinance institutions, which are not regulated directly by BoT but are registered under the Microfinance Act.

Speaking at the signing event in Dar es Salaam, BoT Governor Emmanuel Tutuba said the MoU is part of broader efforts to create an enabling legal and policy environment for the country’s expanding microfinance sector.

He noted that the framework will help strengthen consumer protection, increase professionalism, and improve service delivery in the sector.

Tutuba explained that under the new arrangement, TAMFI and TAMIU will be responsible for monitoring the conduct of their member institutions, enforcing ethical standards, and implementing mechanisms to resolve client complaints.

He added that all Tier 2 microfinance providers are now required to join either TAMFI or TAMIU within six months or risk losing their operating licenses.

The Governor also highlighted the growing challenges facing the sector, including low financial literacy and irresponsible borrowing.

He stated that many borrowers take loans without proper planning, often influenced by advertising, which leads to financial difficulties.

TAMFI Chairperson Devotha Minzi said the MoU represents a major step forward for the sector, allowing for greater efficiency, accountability, and coordination among second-tier microfinance institutions.

Tanzania’s Tier 2 microfinance sector currently comprises over 2,600 institutions operating nationwide.

These institutions play a key role in expanding access to finance, especially for low-income individuals and micro-entrepreneurs who are not served by commercial banks.

BoT introduced specific microfinance regulations in 2019 to structure and supervise the operations of microfinance service providers under the Microfinance Act, with the aim of protecting borrowers and increasing transparency across the sector.