The Bank of Tanzania (BoT) has released its Monthly Economic Review for May 2025, outlining Tanzania’s economic performance for the year ending April.

Table of Contents

Inflation

Overall, domestic inflation remained moderate. Headline inflation was 3.2% in April 2025 compared with 3.3% in the preceding month and 3.1% in the corresponding period in 2024. The change was largely attributed to an increase in food prices. Notably, inflation remained within EAC and SADC’s national targets and regional benchmarks.

Food inflation rose to 5.3% in April 2025, from 1.4% in the corresponding period in 2024. The increase largely stemmed from high staple food crop prices, which have remained above the levels observed a year earlier, amplified by weather-induced supply volatility and logistics.

The National Food Reserve Agency (NFRA) maintained sufficient food stocks. The stock increased to 557,228 tonnes by the end of April 2025, from 340,102 during the same period in 2024. NFRA released 29,834 tonnes of maize to local traders to stabilize the domestic supply.

Core inflation declined to 2.2% in April 2025 from 3.9% in April 2024, reflecting easing underlying price pressures, particularly in non-food categories. Despite moderation, core inflation remained the dominant driver of overall inflation. The contribution of unprocessed food inflation softened during the period, indicating some stabilization in food price pressures.

Energy inflation showed minimal variation, with a limited impact on headline inflation. Energy, fuel, and utilities inflation eased to 7.3% year-on-year in April 2025 from 9.3% in a similar period in 2024, reflecting broad-based disinflation across petroleum products and utilities, particularly petrol and diesel.

Monetary Policy

In April 2025, the Monetary Policy Committee maintained the Central Bank Rate (CBR) at 6%—the rate applicable for the quarter ending June 2025. The decision aimed at maintaining inflation within the medium-term target of 3–5%, smoothing exchange rate volatility while supporting the growth of economic activities.

The implementation of monetary policy during the month therefore aimed at maintaining the 7-day interbank rate within the band of 4 to 8%, thereby ensuring adequate liquidity to support private sector credit expansion.

Notwithstanding the adequacy levels of the liquidity, the 7-day interbank rate hovered near the upper band of the Central Bank Rate (CBR), due to tight liquidity in a few banks resulting from market segmentation.

In line with the adequate level of liquidity in the economy, the growth of extended broad money supply (M3) was high at 20.9%, compared with 17.1% in the preceding month, partly driven by growth of credit to the private sector.

Banks’ Credit to the Private Sector

Private sector credit maintained its upward trajectory, growing at 14.9% in April 2025, from 14.0% in the previous month.

Credit allocation to building and construction activities exhibited the highest growth, registering a rate of 39.2%, followed by agriculture at 29.8%, and transport and communication at 23.8%.

Personal loans, predominantly extended to micro, small, and medium-sized enterprises, continued to constitute the largest proportion of total private sector credit, serving as the primary driver of credit expansion.

Credit to the agriculture and trade sectors represented 13.0% and 12.6% of the total private sector credit, respectively.

Interest Rates

During the reviewed month, lending and deposit interest rates remained largely unchanged. The overall lending rate averaged 15.16%, slightly below the 15.50% recorded in the previous month.

A similar trend was observed on the lending rates charged on the prime customers (negotiated rates), which decreased marginally to 12.88% from 12.94%.

The overall deposit rates declined marginally to 7.82% in April 2025, from 8.10% recorded in the previous month, reflecting improved liquidity conditions. In contrast, negotiated deposit rates edged up slightly to 10.52% from 10.35%.

Meanwhile, the short-term interest rate spread between lending and deposit rates narrowed to 6.88 percentage points, compared to 7.72 percentage points recorded in April 2024.

Financial Markets

Government Securities Market

In April 2025, Government securities auctions were generally oversubscribed, reflecting the adequate level of liquidity in the banking system and increased investor awareness and stable macroeconomic conditions.

The Bank conducted two Treasury bill auctions with a total tender size of TZS 218 billion, mainly to cater for government budget financing and a small portion to facilitate price discovery for short-term financial instruments. Total bids amounted to TZS 275 billion, of which TZS 208.2 billion were successful. Consistently, the overall weighted average yield decreased to 8.86% from 10.10% in the preceding month.

The Bank offered 2-, 10-, and 20-year Treasury bond auctions with a total tender size of TZS 481.7 billion, mainly for government financing. All three auctions were oversubscribed, attracting bids worth TZS 1,076.7 billion, of which TZS 519.6 billion were successful. The weighted average yield for the 2- and 20-year bonds eased to 12.08% and 15.11%, respectively, while that of the 10-year bond increased slightly to 14.26%.

Interbank Cash Market

The interbank cash market (IBCM), which facilitates the distribution of shilling liquidity among banks, continued to operate smoothly in the reviewed month. Total transactions in the market increased to TZS 2,611.1 billion, from TZS 1,757.7 billion in the preceding month.

The 7-day transactions continued to account for the largest share of total transactions at 40.7%, while overnight transactions were around 15.2%. The overall IBCM interest rate decreased slightly to 8.00% from 8.12% in March 2025.

Interbank Foreign Exchange Market

In April 2025, liquidity conditions in the Interbank Foreign Exchange Market (IFEM) remained subdued, similar to the preceding month, in line with the seasonal decline in foreign exchange inflows from cash crop exports.

The Bank participated in the market to support import demand, selling USD 6.25 million, in accordance with the Foreign Exchange Intervention Policy.

Total transactions in the IFEM amounted to USD 12.9 million, compared with USD 70.1 million in the previous month and USD 72 million in the corresponding period of 2024.

The Shilling traded at an average rate of TZS 2,684.41 per USD, compared with TZS 2,650.24 per dollar in March 2025. This was equivalent to an annual depreciation of 3.9%, compared with a depreciation of 3.4% recorded in the previous month.

Government Budgetary Operations

Revenue collection performance remained strong in March 2025, with the Government collecting a total of TZS 3,090.8 billion, 3.1% below the target for the month. Of this amount, the central government collected TZS 2,953.8 billion, representing 95.6% of the total revenue, but slightly below its target of TZS 3,074 billion.

Tax revenue continued to perform robustly, amounting to TZS 2,603.3 billion—2% above the target—largely driven by income tax collections, which exceeded the target by 11.6%.

This strong tax revenue performance was largely attributed to the Government’s ongoing initiatives to enhance revenue collection, including sustained efforts in tax administration. Non-tax revenue amounted to TZS 350.5 billion, falling short of the target of TZS 522.4 billion.

The Government continued to align its expenditure with available resources. In March 2025, total government spending amounted to TZS 3,375.1 billion, including TZS 1,968.4 billion for recurrent expenditures and TZS 1,406.7 billion for development expenditures, including infrastructure and social services.

Debt Developments

The national debt stock recorded a monthly increase of 0.5%, reaching USD 48,479.9 million at the end of April 2025.

External Debt

As at the end of April 2025, the external debt stock (comprising both public and private sector debt) amounted to USD 35,505.9 million, representing 73.2% of the total national debt stock—an increase of 0.5% compared with the stock recorded at the end of the preceding month. Of the total external debt, 76.7% was attributable to the public sector.

External loans disbursed during April 2025 amounted to USD 109.9 million, while external debt service totalled USD 80.9 million. Of the debt service amount, USD 73.5 million was for principal repayments, and the balance covered interest obligations.

The composition of external debt by creditor remained unchanged, with multilateral institutions continuing to hold the largest share. Transportation and telecommunications activities remained the main beneficiary of external loan inflows, while the United States dollar continued to dominate the external debt portfolio by currency.

Domestic Debt

Domestic debt stock amounted to TZS 34,759.9 billion at the end of April 2025, representing a monthly increase of 1.5%. The increase was primarily driven by the issuance of Treasury bonds, which significantly outweighed redemptions, as well as the government’s utilization of the overdraft facility.

Long-term instruments—government stocks and Treasury bonds—continued to dominate the domestic debt portfolio, with commercial banks and pension funds remaining the principal domestic creditors of the Government.

During April 2025, the Government mobilized TZS 625.5 billion from the domestic market to finance its budget, of which TZS 421.7 billion was raised through Treasury bonds and TZS 203.8 billion through Treasury bills.

Meanwhile, the Government spent a total of TZS 640 billion to service the domestic debt, comprising TZS 356.3 billion in principal repayments and TZS 283.7 billion in interest payments.

The outstanding domestic debt of select State-Owned Enterprises (SOEs) at the end of April 2025 was TZS 84 billion, an increase of TZS 0.2 billion compared to the preceding month’s position.

External Sector Performance

The external sector performance continued to improve, with the current account deficit narrowing to USD 2,224.9 million compared with USD 2,733.4 million in the year ending April 2024. The performance was largely attributed to stronger growth in exports of goods and services relative to imports.

Foreign exchange reserves were USD 5,307.7 million at the end of April 2025, adequate to cover 4.3 months of projected imports of goods and services. The reserves were above the country benchmark of 4 months.

Exports

Exports of goods and services grew by 16.8% to USD 16,684.3 million, from USD 14,281.7 million in the year ending April 2024. The increase was driven by exports of gold, travel (tourism), agricultural products, and transportation services.

Exports of goods, which accounted for 58.4% of the total exports of goods and services, rose to USD 9,743.5 million from USD 7,815.8 million during the year ending April 2024. The increase was driven by exports of gold, cashew nuts, coffee, tobacco and horticultural products.

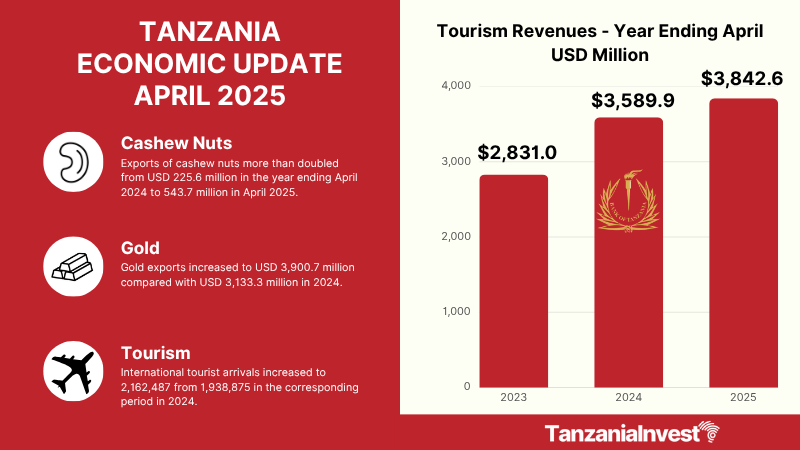

Gold exports increased to USD 3,900.7 million compared with USD 3,133.3 million in 2024, owing to favourable prices in the world market.

Traditional exports also rose, with much of the increase registered in cashew nuts, coffee, and tobacco. However, export of manufactured products declined due to a slowdown in the exports of fertilizers, cement, and ceramic products.

On a monthly basis, exports of goods were USD 708.6 million in April 2025, up from USD 556.4 million in April 2024, driven by gold and cashew nuts.

During the review period, service receipts rose by 7.3% to USD 6,940.8 million, from USD 6,466.0 million in 2024, owing to an increase in travel (tourism) receipts. Travel receipts accounted for 56% of the total service receipts. The increase in travel receipts was largely explained by a surge in international arrivals to 2,162,487 in the year to April 2025 from 1,938,875 in the corresponding period in 2024.

Imports

Imports of goods and services were USD 17,560.4 million during the year ending April 2025, up from USD 16,110.2 million in the corresponding period in 2024. The increase was driven by imports of industrial transport equipment and supplies and freight payments.

Month-on-month, imports of goods decreased to USD 1,579.1 million in April 2025, from USD 1,166.8 million in April 2024.

Services payments increased by 22.8% to USD 2,842.6 million, from USD 2,314.6 million, buoyed by high freight payments, which accounted for 53.3% of total services payments. On a monthly basis, service payments rose by 48.7% to USD 258.8 million in April 2025, compared with USD 174.1 million in April 2024.

The primary income account deficit widened to USD 1,881.5 million, up from USD 1,572.7 million in 2024, owing to increased payment of income on equity and interest abroad. On a monthly basis, the deficit narrowed to USD 196.9 million in April 2025 from USD 202.1 million in April 2024.

The secondary income account recorded a surplus of USD 532.7 million, down from USD 667.8 million in the corresponding period in 2024, due to a decrease in personal transfers. On a monthly basis, the surplus amounted to USD 5.8 million in April 2025 compared with USD 3.9 million in April 2024.