The Bank of Tanzania (BoT) has released its Monthly Economic Review–July 2025, outlining Tanzania’s economic performance for the year ending June.

Table of Contents

Inflation

Inflation remained low, albeit with a slight uptick on account of an increase in prices of food and nonalcoholic beverages.

Twelve-month headline inflation was 3.3% in June 2025 compared with 3.2% in the preceding month.

Food inflation (food and non-alcoholic beverages) rose to 7.3% in June 2025, from 5.6% in May 2025. Much of the increase was attributed to rising prices of some staple and alternative foods. The increase was notable in maize flour, millet flour, beef, and fish.

To ease price pressures, the National Food Reserve Agency (NFRA) released a net total of 32,414 tonnes of maize during the month. This action reduced food reserves slightly from 509,990 tonnes in May 2025 to 477,923 tonnes in June 2025. Despite the decrease, the stock level remained well above the 340,479 tonnes recorded during the same period in 2024.

While core inflation continued to ease, inflation for unprocessed foods surged to 8.6% in June 2025, from 5.5% in the previous month. Notably, unprocessed food remained the primary driver of headline inflation, highlighting the influence of food prices on overall inflation trends.

Inflation for energy, fuel, and utilities decelerated to 2.1% in June 2025, from 6.1% in the previous month. The decline was primarily attributed to the continued softening of wood charcoal prices.

In addition, prices of key petroleum products—including petrol, diesel, and kerosene—have been on a downward trend since April 2025, in line with global oil market developments. This moderation has played a significant role in stabilizing overall headline inflation.

Monetary Policy

During June 2025, the Bank continued to implement the monetary policy in line with the April 2025 Monetary Policy Committee (MPC) decision to maintain the Central Bank Rate (CBR) at 6% for the quarter ending June 2025.

This decision aimed to cushion the domestic economy against adverse spillover effects from elevated trade tariffs and ongoing geopolitical tensions, while simultaneously ensuring sufficient liquidity to sustain private sector credit growth and anchor inflation expectations within the 3-5% target range.

Despite adequate overall liquidity, the 7-day interbank rate remained persistently near the upper band of the CBR corridor, reflecting segmentation in the money market.

The ongoing reforms on the collateral management framework and interbank market structure are expected to improve liquidity allocation and reduce interbank disparities.

Extended broad money supply (M3) recorded an annual growth of 18.7% in June 2025, slightly above the 18.3% recorded in May 2025, reflecting sustained expansion in credit to the private sector.

Banks’ Credit to the Private Sector

The growth of private sector credit moderated to 15.9% in June, from a peak of 17.1% in May 2025, partly associated with low demand for credit due to end of financial year obligations– mainly tax payments.

Credit extended to agricultural activities recorded the highest annual growth at 30.2%, reflecting a strong demand within the sector.

Building and construction, along with transport and communication, followed closely, each registering growth rates of 25.7%.

In terms of composition, personal loans remained the largest component of private sector credit, accounting for 35.3% of the total.

These loans are primarily extended to micro, small, and medium-sized enterprises for productive purposes and continue to be a major contributor to overall credit expansion.

Trade and agriculture sectors accounted for 13.6% and 14% of total private sector credit, respectively.

Interest Rates

Interest rates remained broadly stable during the month. The overall lending rate averaged 15.23% in June 2025, slightly increasing from 15.18% in May. Lending rates to prime customers (negotiated rates) declined marginally to 12.68%, down from 12.99%.

On the deposit side, interest rates exhibited a mild uptick. The overall deposit rate rose to 8.74%, compared to 8.58% in the previous month. Negotiated deposit rates increased to 11.21%, up from 10.64% in May.

This reflects stronger demand for liquidity during the month, driven by rising credit needs and end-of-financial-year obligations. As a result, the short-term interest rate spread between lending and deposit rates narrowed to 5.90 percentage points in June 2025, down from 6.49 percentage points recorded in June 2024.

Financial Markets

Government Securities Market

The Bank successfully conducted auctions for 20-year and 25-year Treasury bonds, attracting a combined tender size of TZS 638.7 billion. The proceeds were primarily for financing government budgetary operations.

The auctions were significantly oversubscribed, attracting bids worth TZS 1,232.9 billion, of which TZS 322.4 billion were accepted.

Driven by strong market demand, the weighted average yields declined to 14.50% for the 20-year bond and 14.80% for the 25-year bond.

Having met the domestic financing requirements for the 2024/25 fiscal year, the Bank refrained from issuing any short-term instruments. Thus, no Treasury bill auctions were held in June 2025.

Interbank Cash Market

The interbank cash market (IBCM) remained active in facilitating liquidity distribution among banks. During the review month, total market turnover reached TZS 2,873.9 billion, down from TZS 3,267 billion in May, but significantly higher than TZS 1,277.6 billion recorded in June 2024.

The market activities were dominated by overnight placements, accounting for 37.3% of total trades, followed closely by the 7-day tenor at 26.5%.

The overall IBCM interest rate slightly eased to 7.93%, compared to 7.98% in May 2025, reflecting market stability for short-term funding.

Interbank Foreign Exchange Market

Liquidity conditions in the Interbank Foreign Exchange Market (IFEM) continued to improve in June 2025, supported by the onset of seasonal inflows from cash crops and an increase in gold exports.

Owing to improved foreign exchange liquidity, the Bank’s intervention, which is in accordance with the Foreign Exchange Intervention Policy, declined to USD 6.3 million from USD 53 million in the previous month.

Total IFEM turnover rose to USD 121.5 million, compared to USD 110.8 million in May and USD 9.2 million in June 2024.

The Tanzanian Shilling strengthened against major currencies, trading at an average of TZS 2,631.56 per USD in June, up from TZS 2,698.42 per USD in the previous month. Accordingly, the annual depreciation rate of the Shilling slowed significantly to 0.21%, compared to 3.82% in May and 12.5% in June 2024.

Government Budgetary Operations

In May 2025, revenue collections outperformed the monthly target. Total government revenue amounted to TZS 2,880.2 billion, surpassing the target by 3.1%.

Of this amount, the Central Government contributed TZS 2,768.5 billion, accounting for 96.1% of total domestic revenue and surpassing the target of TZS 2,685.2 billion.

Tax revenue continued to demonstrate strong performance, reaching TZS 2,339.7 billion, which was 4.1% above the monthly target. This outcome reflects the positive impact of sustained efforts in enhancing tax administration.

Meanwhile, non-tax revenue totaled TZS 428.8 billion, falling short of the target of TZS 437.8 billion.

The Government continued to align its expenditures with available resources. In May 2025, total expenditure amounted to TZS 3,150.4 billion, of which TZS 2,213.1 billion was recurrent spending and TZS 937.3 billion was allocated to development projects.

Debt Developments

The national debt stock stood at USD 46,586.6 million at the end of June 2025, 1% higher compared with the stock recorded at the end of May 2025. Of the total debt stock, 70.7% was external debt.

External Debt

The external debt stock (public and private) recorded a monthly increase of 0.1% to USD 32,955.5 million at the end of June 2025.

Of the total amount, 85.4% constituted public debt, while the remaining portion was attributed to private sector debt.

External loan disbursed during the month amounted to USD 868.4 million, primarily directed to the central government.

External debt service payments amounted to USD 234.4 million, of which USD 173.6 million was allocated to principal repayments, while the remainder covered interest payments.

The composition of external debt by creditor remained largely unchanged from both the previous month and the corresponding period in 2024, with multilateral institutions continuing to hold the largest share, followed by commercial lenders.

Transportation and telecommunications sectors remained the largest holders of disbursed outstanding debt.

In terms of currency composition, the US dollar continued to dominate, followed by the Euro.

Domestic Debt

As of the end of June 2025, the stock of domestic debt stood at TZS 35,502.8 billion, a monthly increase of 0.9%.

The increase was primarily driven by the issuance of government securities, which exceeded redemptions.

Treasury bonds continued to dominate the domestic debt portfolio, with commercial banks and pension funds remaining the main domestic creditors to the Government.

During June 2025, the Government raised a total of TZS 845.9 billion from the domestic market through the issuance of Government bonds to finance the budget shortfall.

Meanwhile, the Government spent a total of TZS 936.96 billion on domestic debt service, of which TZS 660.13 billion was principal repayments and TZS 276.8 billion was interest payments.

The outstanding domestic debt of select State-Owned Enterprises (SOEs) at the end of June 2025 was TZS 83.9 billion, an increase of TZS 0.5 billion compared to the previous month’s position.

External Sector Performance

The external sector continued to show improvement in the year ending June 2025, as evidenced by a reduction in the current account deficit to USD 2,117.6 million from USD 2,797.7 million in the corresponding period of 2024.

The improvement was primarily driven by a larger trade surplus, resulting from a stronger increase in exports of goods and services relative to imports.

Foreign exchange reserves increased to USD 5,971.5 million at the end of June 2025, from USD 5,345.5 million recorded in the same period of 2024.

This level of reserves is adequate to cover 4.8 months of projected imports of goods and services, surpassing both national and East African Community (EAC) adequacy benchmarks.

Exports

During the year ending June 2025, exports of goods and services rose markedly by 17.7% to USD 16,926.4 million compared to USD 14,380.2 million in the corresponding period of 2024.

This growth was largely driven by increased gold exports, along with significant expansion in travel (tourism) and transportation services.

Exports of goods, which accounted for 57.9% of total exports of goods and services, rose to USD 9,816.1 million in June 2025, up from USD 7,801.5 million in June 2024.

This growth was largely driven by increased exports of gold, cashew nuts, tobacco, horticultural products, and coffee.

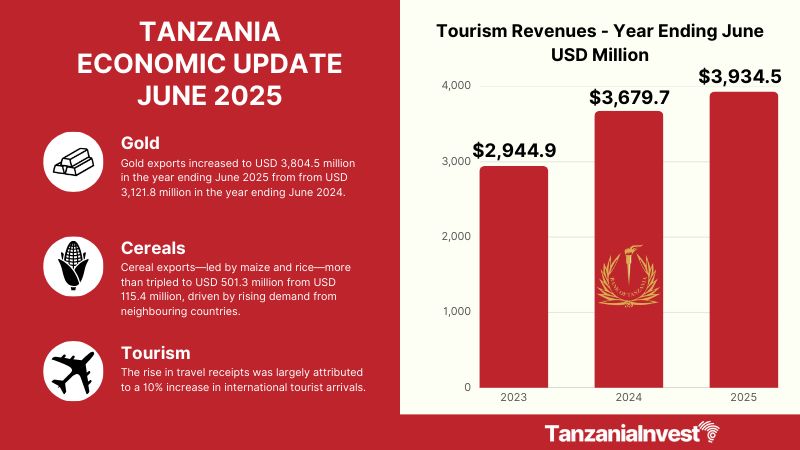

Gold exports alone increased to USD 3,804.5 million from USD 3,121.8 million, supported by favourable global market prices and purchases by the Bank of Tanzania.

Traditional exports grew to USD 1,461.7 million compared to USD 1,036 million, driven by higher export volumes of cashew nuts, tobacco, and coffee.

Manufactured exports also recorded gains, particularly in iron and steel, edible oil, and fertilizers.

Notably, cereal exports—led by maize and rice—more than tripled to USD 501.3 million from USD 115.4 million, driven by rising demand from neighbouring countries.

On a monthly basis, goods exports were USD 618.3 million in June 2025, compared with USD 697 million in June 2024, with gold and tobacco remaining the key contributors.

Service receipts rose to USD 7,110.4 million in the year ending June 2025, from USD 6,578.7 million in the corresponding period of 2024. The growth was primarily driven by increased activity in travel (tourism) and transport services.

The rise in travel receipts was largely attributed to a 10% increase in international tourist arrivals, which reached 2,193,322—up from 1,994,242 in the corresponding period of 2024—reflecting a global rebound in tourism across all regions.

Imports

Import of goods and services rose to USD 17,603.1 million in the year ending June 2025, from USD 16,144.9 million in the corresponding period of 2024.

The increase was primarily driven by greater inflows of industrial transport equipment and raw materials, alongside a rise in freight-related payments.

Notably, oil imports, which account for approximately 17% of total goods imports, declined to USD 2,517.1 million from USD 2,802.2 million, mainly due to easing global prices.

On a monthly basis, goods imports stood at USD 1,277.6 million in June 2025, compared to USD 1,008 million in June 2024.

Service payments increased to USD 2,894 million in the year ending June 2025, from USD 2,359.5 million recorded in 2024, largely attributed to increased freight payments.

On a monthly basis, service payments reached USD 250.1 million in June 2025, compared to USD 189.3 million in June 2024.

The primary income account recorded a deficit of USD 1,949.6 million in the year ending June 2025, up from USD 1,653.9 million in the previous year.

This increase was mainly attributed to higher payments of income on equity and interest to non-residents.

On a monthly basis, the primary income account registered a deficit of USD 132.9 million in June 2025, slightly lower than the USD 145.6 million recorded in June 2024.

The secondary income account recorded a surplus of USD 508.7 million, compared with USD 620.9 million in the corresponding period in 2024, due to a decrease in personal transfers.

On a monthly basis, the surplus amounted to USD 30.7 million in June 2025, compared with USD 38.3 million in June 2024.