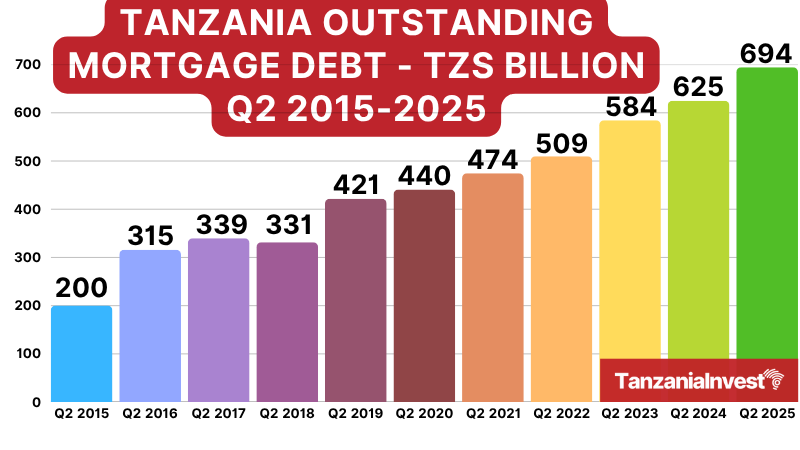

In the second quarter of 2025, the mortgage market in Tanzania registered a 1.7% growth in the value of mortgages provided by the banking sector for the purposes of residential housing compared to the first quarter of 2025.

The value in residential mortgages went from TZS 683.03 billion recorded on 31 March 2025 to TZS 694.35 billion (USD 263.88 million) as of 30 June 2025.

This was indicated in the Tanzania Mortgage Market Update – 31 June 2025, recently released by the Bank of Tanzania (BOT).

On a year-to-year comparison, a growth of 11.10% was registered in the value of mortgage loans between 31 June 2024 and 31 June 2025.

Tanzania Mortgage Market Demand and Supply in Q2 2025

The Update explains that the demand for housing and housing loans remains extremely high as it is constrained by an inadequate supply of equitable houses and high-interest rates charged on housing loans.

The Tanzanian housing demand, which is estimated at 200,000 houses annually and a total housing shortage of 3 million houses, has been boosted by easy access to mortgages, with the number of mortgage lenders in the market increasing from 3 in 2009 to 29 by 30 June 2025.

The mortgage market is dominated by five top lenders, who commanded 63& of the market. CRDB Bank Plc is the market leader commanding 32.05% of the mortgage market share, followed by NMB Bank (11.85%), Azania Bank. (8.36%), First Housing Finance Company Limited (5.86%) and Stanbic Bank (5.23%).

Most lenders offer loans for home purchase and equity release, while a few offer loans for self-construction, which continue to be expensive and beyond the reach of the average Tanzanian.

While interests on residential mortgages improved from 22–24% in 2010 to 13–19% offered today, market interest rates are still relatively high hence negatively affecting affordability.

Additionally, cumbersome processes around the issuance of titles (especially unit titles) continue to pose a challenge by affecting borrowers’ eligibility to access residential mortgages.

Further, competition in the market has led to the emergence of other products that are impacting mortgage market growth as the products have favorable terms than mortgage products and are used for housing purposes.

These products compete with mortgages in terms of loan amount and, to some extent, tenor as they are offering consumer loans for up to seven years, amounting to more than TZS 150 million, an amount enough to buy a housing unit.

The competition comes from the ease with which competing products, specifically, consumer loans, are available relatively easily compared to the lengthy process experienced in mortgage loans, as well as additional costs in mortgage loans, including registration costs, valuation fees, and insurance costs, which are not applicable in consumer loans.