The Tanzania Communication Regulatory Authority (TCRA) has released its Communication Statistics for the quarter ending April 2025, covering telecommunication, internet, mobile money usage, and other statistics and services.

Table of Contents

Telecom Subscriptions

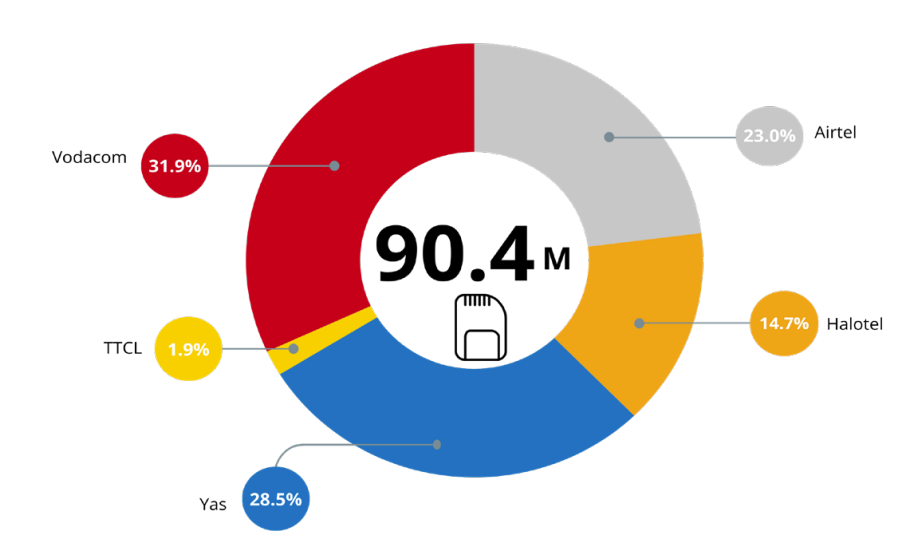

The total number of telecom subscriptions in Tanzania increased by 4.1% from 86.8 million during the quarter ending December 2024 to 90.4 million subscriptions as of March 2025.

Tanzania Mobile and Fixed Subscriptions – Q1 2025

| Month | Mobile Subscriptions | Fixed Subscriptions | TOTAL |

| January | 88,092,790 | 79,040 | 88,171,830 |

| February | 89,294,910 | 78,877 | 89,373,787 |

| March | 90,298,941 | 79,054 | 90,377,995 |

Mobile Subscriptions

Mobile subscriptions represented 99.9% of all subscriptions.

SIM card subscriptions are categorized for Person-to-Person (P2P) and for Machine-to-Machine (M2M).

Vodacom had the largest market share (31.9%), followed by Yas (28.5%) and Airtel (23.0%).

No operator in Tanzania has a market share greater than 35%, a minimum significant level for a dominant operator, indicating healthy competition among operators.

Number of P2P Subscriptions per Operator – Q1 2025

| Month | Airtel | Halotel | Yas | TTCL | Vodacom | TOTAL |

| January | 20,265,556 | 12,733,755 | 25,706,939 | 1,680,856 | 26,763,073 | 87,150,179 |

| February | 20,406,555 | 13,097,820 | 25,523,614 | 1,705,972 | 27,606,485 | 88,340,446 |

| March | 20,444,505 | 13,200,102 | 25,656,420 | 1,725,612 | 28,301,079 | 89,327,718 |

Concerning M2M (Machine-to-Machine) mobile subscriptions, Vodacom controls the market again. Airtel ranks second, followed by Halotel, Yas, and TTCL.

Number of M2M Subscriptions per Operator – Q1 2025

| Month | Airtel | Halotel | Yas | TTCL | Vodacom | TOTAL |

| January | 340,406 | 74,259 | 50,915 | 4,503 | 551,568 | 1,021,651 |

| February | 342,078 | 76,359 | 51,649 | 4,499 | 558,756 | 1,033,341 |

| March | 343,627 | 76,937 | 56,568 | 4,505 | 568,640 | 1,050,277 |

Tanzania Telecom Operators Subscriptions Market Shares – March 2025

As of March 2025, the penetration of smartphones decreased to 35.29% from 35.99% recorded in December 2024. The penetration of feature phones also decreased from 87.39% in December 2024 to 82.64% in March 2025.

Mobile Money

Mobile Money Subscriptions

Mobile money subscriptions refer to the number of active SIM cards with mobile money service accounts that have been used at least once in the past three months.

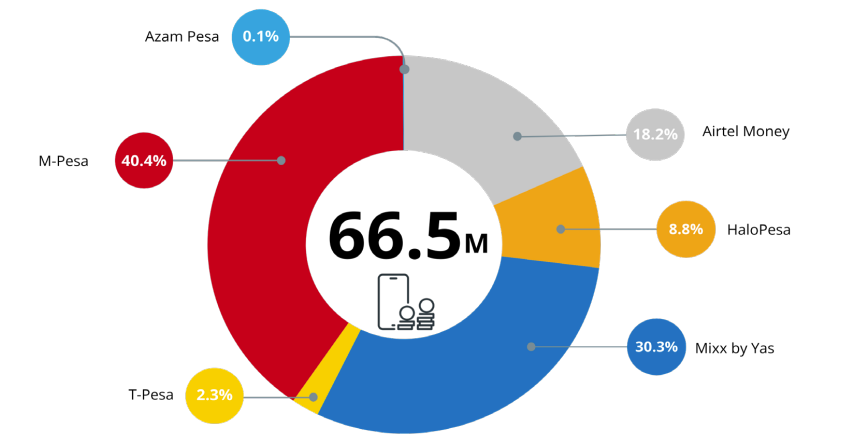

Subscriptions increased by 5.3% from 63.2 million accounts in the quarter ending December 2024 to 66.5 million in March 2025.

The mobile money market is very competitive as Mixx by Yas, M-Pesa, and Airtel money control around 89% of the market share by subscription, led by M-Pesa with 40.4% market share.

Tanzania Market Share on Mobile Money Subscriptions – March 2025

Mobile Money Transactions

Mobile money transactions reached 1,366,334,366 in Q1 2025, marking a 24.13% increase from 1,100,700,205 in Q4 2024.

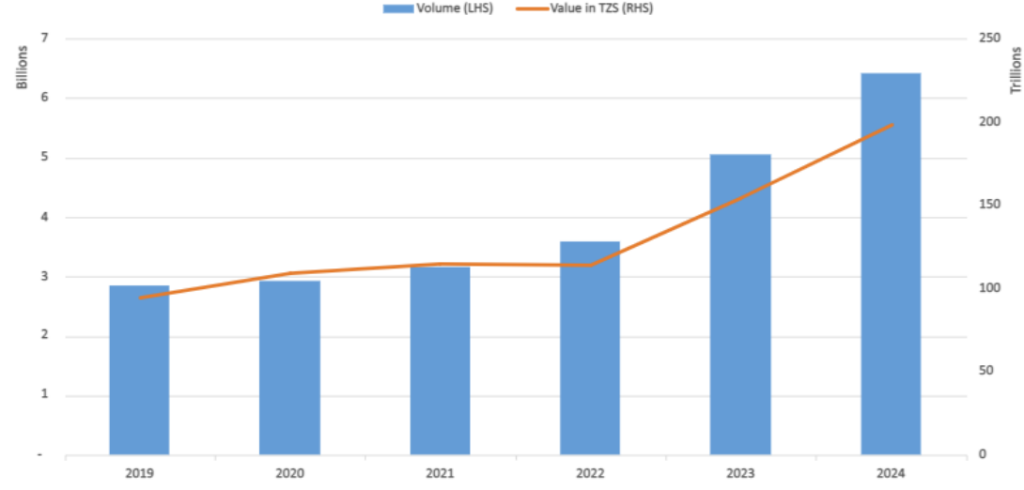

In its Communication Statistics, TCRA did not disclose the value of mobile money transactions. However, the Bank of Tanzania’s (BOT) Third Annual Payment Systems Report indicates that mobile payment transactions in the country increased by 26.73% to 6.41 billion in 2024, up from 5.06 billion in 2023.

Tanzania Mobile Payments Indicators 2019-2024

Internet Subscriptions

As of March 2025, there were 49.3 million internet subscriptions, representing an increase of 2.7% from 48 million in December 2024.

Mobile broadband is the most popular means of accessing the internet, with 27,064,368 subscriptions. 2G technology holds significant usage with 22,037,228 subscriptions. Fibre technologies like Fiber to the Home (FTTH) and Fiber to the Office (FTTO) have fewer subscriptions, at 77,940 and 13,685, respectively.

The average internet speed for mobile broadband was 12.5 Mbps in Upload and 10.8 Mbps in download, with a latency of 77.8 ms.

However, the average internet speed for fixed broadband was 35.9 Mbps in Upload and 31.8 Mbps in download, with a latency of 18.6 ms.

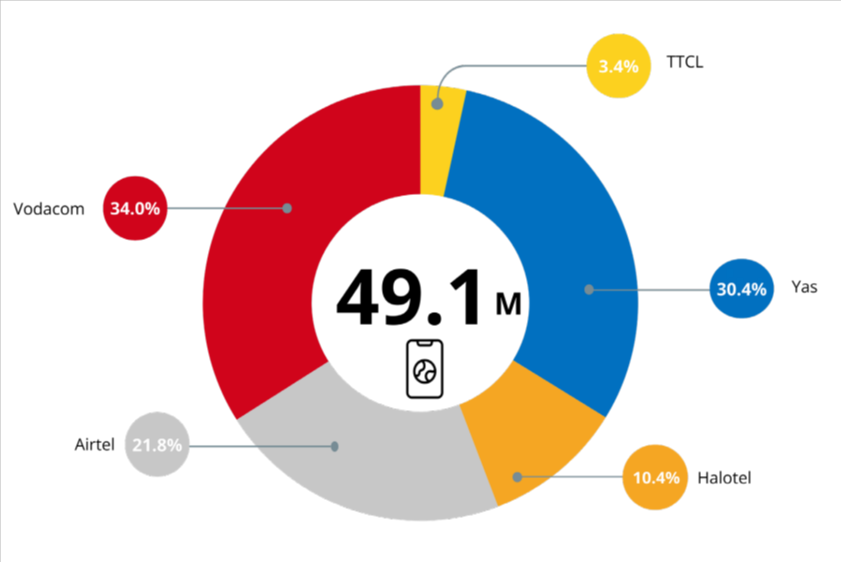

Tanzania Mobile Internet Market Share by Subscription per Operator – March 2025