The Bank of Tanzania (BOT) has released its Monthly Economic Review for February 2025, providing insights into the country’s economic performance for January 2025. The report highlights stable inflation, growth in private-sector credit, and improvements in the external sector performance.

Inflation

Inflation remained subdued in January 2025, with headline inflation at 3.1%, the same as in December 2024, and slightly higher than the 3% recorded in January 2024. This level is well below the medium-term target of 5% and aligns with the East African Community (EAC) and Southern African Development Community (SADC) convergence criteria.

The stability in inflation was attributed to a decline in energy, fuel, and utilities inflation, which dropped to 3.5% in January 2025 from 5.3% in December 2024. Core inflation also eased to 2.7%, down from 3.3% in December 2024, reflecting moderation in the prices of non-food items such as building materials and household appliances. However, food inflation rose to 5.3% from 4.6% in the previous month, driven by higher prices for maize, beans, and finger millet.

Monetary Policy

The Bank of Tanzania maintained the Central Bank Rate (CBR) at 6% for the quarter ending March 2025, aiming to anchor inflation expectations and ensure sufficient liquidity to support economic growth. The 7-day interbank cash market (IBCM) rate averaged 7.83% in January 2025, remaining within the target band of 4–8%.

Extended broad money supply (M3) grew by 13.9% in January 2025, up from 11.1% in December 2024, driven by increased private sector credit and a rise in net foreign assets. Private sector credit grew by 12.8%, compared to 12.4% in December 2024, with significant growth in the agriculture, manufacturing, and trade sectors.

Credit to Private Sector

Private sector credit grew by 12.8% in January 2025, compared to 12.4% in December 2024, reflecting increased demand for financing across various sectors. The agriculture sector recorded the highest growth in credit at 42.5%, driven by strong demand following favorable weather and bumper harvests. Credit to the manufacturing sector grew by 17.1%, while trade activities saw an expansion of 15.2%. Personal loans remained the largest recipient of credit, accounting for 38.1% of total private sector credit, reflecting sustained demand for consumer financing.

Interest Rates

Interest rates on loans and deposits showed mixed trends in January 2025. The overall lending rate declined to 15.12% from 15.17% in December 2024, while the negotiated lending rate increased slightly to 12.85% from 12.83%. Deposit rates also rose, with the overall deposit rate increasing to 8.35% from 8.33% in December 2024.

Financial Markets

Government Securities Market

In January 2025, the Bank of Tanzania conducted Treasury bill and bond auctions to meet government financing needs. The weighted average yield for Treasury bills increased to 12.9% from 12.86% in December 2024. The 20-year Treasury bond auction saw strong demand, with a weighted average yield to maturity of 15.75%, up from 15.71% in December 2024.

Interbank Cash Market

The Interbank Cash Market (IBCM) continued to facilitate the distribution of shilling liquidity among banks. During January 2025, the total value of transactions in the market amounted to TZS 2,245.8 billion, compared to TZS 1,616.8 billion in December 2024. The 7-day transactions accounted for 42.9% of the total market turnover, while overnight transactions accounted for 18%. This reflects an improvement in the overall liquidity level in the market. The overall IBCM interest rate increased to 7.80% from 7.41% recorded in December 2024.

Interbank Foreign Exchange Market

Activities in the Interbank Foreign Exchange Market (IFEM) declined relative to the preceding month, though market participation remained stronger than a year earlier. Total market transactions amounted to USD 16.3 million, compared to USD 95.7 million traded in December 2024 and USD 3.8 million recorded during the corresponding period in 2024. The Tanzanian shilling remained stable, trading at an average of TZS 2,420.84 per US dollar.

Debt Developments

The national debt stock remained broadly stable at USD 47,640.5 million in January 2025, reflecting a slight decline of 0.1% from the previous month. Of this, 71.2% constituted external debt.

External Debt

The total external debt stock stood at USD 33,905.1 million, with the central government accounting for 76.4% of the total. The private sector held 23.6%, while public corporations accounted for a negligible share. The currency composition of external debt remained dominated by the US dollar at 68.1%, followed by the Euro at 16.1% and the Chinese Yuan at 6.3%.

The disbursed outstanding external debt was USD 32,090.0 million, while undisbursed debt amounted to USD 5,421.5 million. The largest share of external debt was owed to multilateral creditors, accounting for 53.9%, followed by commercial creditors at 36.3%, bilateral creditors at 4.2%, and export credit agencies at 5.6%.

Domestic Debt

The domestic debt stock increased by TZS 1,505.6 billion, reaching TZS 34,154.9 billion at the end of January 2025. This increase was attributed to higher utilization of the overdraft facility and the issuance of long-term government securities, which outweighed redemptions. Treasury bonds continued to dominate the domestic debt portfolio, accounting for 78.2% of the total. Commercial banks and pension funds remained the primary domestic creditors.

External Sector Performance

The external sector continued to improve, reflecting improvements in both global and domestic conditions. During the year ending January 2025, the current account deficit narrowed by 31.1% to USD 2,021.5 million, supported by robust growth in export earnings amid a modest increase in the importation of goods and services.

Consistently, foreign exchange reserves rose to USD 5,323.6 million in January 2025, compared with USD 5,107.1 million in the same period of 2024. These reserves were sufficient to cover 4.3 months of projected imports, exceeding the national benchmark of 4 months.

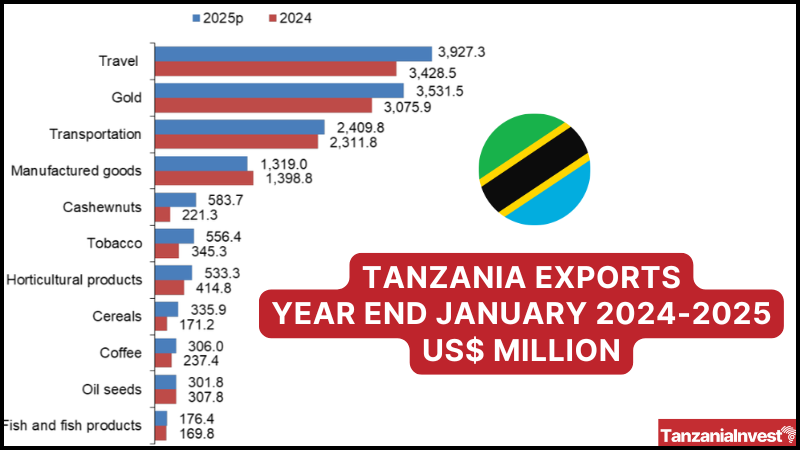

Exports

Exports of goods and services grew by 15.1% to USD 16,093.1 million in the year ending January 2025, up from USD 13,980.3 million in the corresponding period of 2024. This growth was driven by increased export earnings from minerals, agricultural products, and services, particularly tourism and transportation.

Goods exports reached USD 9,144.8 million, an increase of 18.8% from USD 7,696.6 million in 2024. Gold remained the largest contributor, with export earnings amounting to USD 3,369.7 million, accounting for 36.8% of total goods exports. This performance was primarily driven by favorable global gold prices.

Traditional exports totaled USD 1,372.2 million, with cashew nuts, tobacco, and coffee being the top contributors. On a monthly basis, goods exports amounted to USD 847.6 million in January 2025, compared to USD 589.8 million in January 2024, driven by higher cashew nut and gold exports.

Service receipts increased by 10.6% to USD 6,948.2 million in the year ending January 2025, up from USD 6,283.7 million in the corresponding period of 2024. This growth was largely attributed to higher earnings from tourism and transportation services.

Tourism receipts (classified as travel services) rose by 8.38% to USD 3,656.7 million, supported by an increase in international tourist arrivals. Transportation services also performed strongly, contributing significantly to the overall growth in service receipts.

Imports

Imports of goods and services grew moderately in the year ending January 2025, rising to USD 16,872.7 million from USD 16,036.9 million in the same period of 2024. This moderation was attributed to reduced imports of refined petroleum products, machinery, and wheat grain, which collectively accounted for 23.5% of total imports. However, a notable rise was registered in imports of industrial supplies, transport equipment, and associated accessories, reflecting increased activities in the manufacturing, construction, and transportation sectors.

On a monthly basis, imports of goods amounted to USD 1,102 million in January 2025, higher than USD 1,042 million in January 2024, explained by the increase in imports of industrial transport equipment, parts, and accessories.

Service payments rose by 10.2% to USD 2,533.8 million in the year ending January 2025, compared to USD 2,299.3 million in the same period in January 2024. The rise was largely associated with higher freight payments, which contributed 50.7% of total service payments. On a monthly basis, service payments amounted to USD 238.7 million in January 2025, up from USD 185.7 million in January 2024.

During the period under review, the primary income account deficit was USD 1,816.2 million, higher than USD 1,603.3 million in 2024, explained by the increase in the payment of income on equity and higher interest payments abroad. On a monthly basis, the account deficit was USD 103.5 million in January 2025, from USD 132.6 million in January 2024.

The secondary income account recorded a surplus of USD 589.1 million in the year ending January 2025, down from USD 687.3 million in 2024, largely explained by personal transfers. However, on a monthly basis, the surplus in the account increased to USD 66.7 million in January 2025 from USD 25.1 million in January 2024.