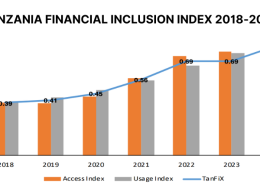

Tanzania has been recently ranked in the 12th position among 21 countries in the last Brookings Financial and Digital Inclusion Project (FDIP), developed to evaluate the access to and usage of affordable financial services in geographically and economically diverse countries.

The ranking published by Brookings Institution, a private non-profit organization devoted to independent research and policy solutions, highlighted the achievements in gender equality in Tanzania where 34% of women own a financial account.

In addition, the ranking stresses the popularity of mobile payment accounts in Tanzania where 40% of adults and more than half of farmers are currently using the service, compared with an average of 12% adults in the Sub Saharan region and merely 2% in the world according to World Bank statistics.

In fact, Tanzania is one of five countries in Africa where adults own a mobile money account rather than a conventional bank account, far above the Sub Saharan average of adults using mobile accounts at 10% according to the World Bank.

Regarding to usage of mobile money accounts, the report points out the high number of monthly transactions in Tanzania which is over the 95 million and that has increased competition among mobile network operators with Vodacom, Airtel, Zantel, and Tigo offering mobile money platforms.

Consequently, Tanzania is ranked in a top position globally among the developing countries in terms of regulatory environment for digital financial services, since its “test and learn” approach has brought to its population mobile money innovations as interest bearing accounts and international remittances, the report stated.

According to WorldRemit, an online platform to transfer money in and between countries, 80% of its international money transfers to Tanzania go to a mobile money account which are currently receiving most of the about USD 64 million sent to the country every year.