On 19th June 2024, the European Union (EU) conducted an informative session titled “Grow with the European Union Finance” in Dar es Salaam, Tanzania, emphasizing financial opportunities for local businesses under the Global Gateway strategy.

The EU Global Gateway strategy is an initiative aimed at enhancing the EU’s engagement with global partners, particularly in developing countries

The recent session follows up on discussions from the Tanzania-EU Business Forum held in February 2023, which underscored the crucial need for enhanced access to finance.

Building on the momentum from the forum, where significant financing agreements were inked between European Development Banks and Tanzanian banks (NMB, CRDB, KCB), the EU aimed to address the persistent challenge of securing finance for scaling up businesses, trade, and investment prospects.

The primary objective of this information session was to provide concrete guidance on the available financing instruments and the process of accessing these funds.

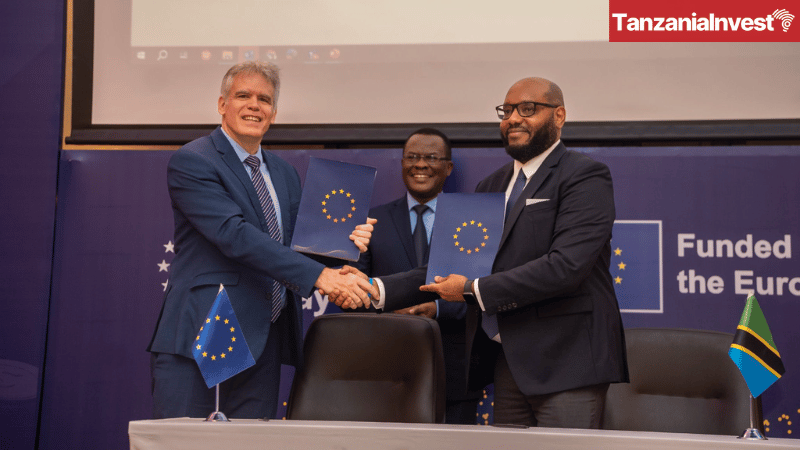

A significant highlight was the signing of a new financing tool grant contract worth TZS 11.23 billion (EUR 4 million) between the EU and the Financial Sector Deepening Trust (FSDT), aimed at promoting inclusive finance for small and medium-sized enterprises (SMEs) operated by women and youth.

Over 100 representatives from the banking sector, SMEs, MSMEs, and various corporate enterprises participated in the session, emphasizing the critical demand for local businesses to connect with EU-catalyzed financiers through the Global Gateway financing tools.

Cedric Merel, Head of Cooperation for the EU Delegation to Tanzania, highlighted the EU’s holistic approach to supporting Tanzania’s business environment: “A conducive business environment is crucial for enterprise development, with finance serving as its lifeblood. The EU remains committed to a comprehensive investment strategy in Tanzania, encompassing regulatory reform support through the Blueprint agenda, bolstering domestic resource mobilization, strengthening capital markets, promoting green finance, and attracting international investments.”

Edward Claessen, Head of the Regional Hub for East Africa at the European Investment Bank (EIB), underscored the EIB’s robust backing for Tanzanian private sector initiatives: “In the past year alone, Tanzania received substantial support from the EIB, amounting to TZS 758 billion (EUR 270 million). This funding, deployed in partnership with local banks like CRDB, NMB, and KCB-Tanzania, has already benefited over 10,000 enterprises, including more than 3,000 women-led businesses and 900 blue economy enterprises in Zanzibar.”

Charles Mwamwaja, Commissioner for Financial Sector Development at the Ministry of Finance of Tanzania, affirmed the government’s alignment with EU strategies: “Our collaboration with the EU and other stakeholders aligns seamlessly with our national development policies, particularly in empowering SMEs. The recent grant of TZS 11.23 billion (EUR 4 million) to the Financial Sector Deepening Trust (FSDT) is pivotal in catalyzing growth and resilience within our SME sector.”

Gasper Mdee, the representative from the Tanzanian Private Sector Foundation (TPSF), applauded the EU’s efforts in fostering a robust entrepreneurial ecosystem: “The financial opportunities offered by the EU are instrumental in nurturing a thriving business environment in Tanzania. By prioritizing inclusive growth, the EU ensures that marginalized groups, including women and youth, access the resources they need to thrive, thereby contributing significantly to our national economic development.”

In its closing remarks, the EU emphasized its commitment to strengthening partnerships with Tanzania’s government, private sector organizations, and development partners to sustainably enhance access to markets, capital, and knowledge.