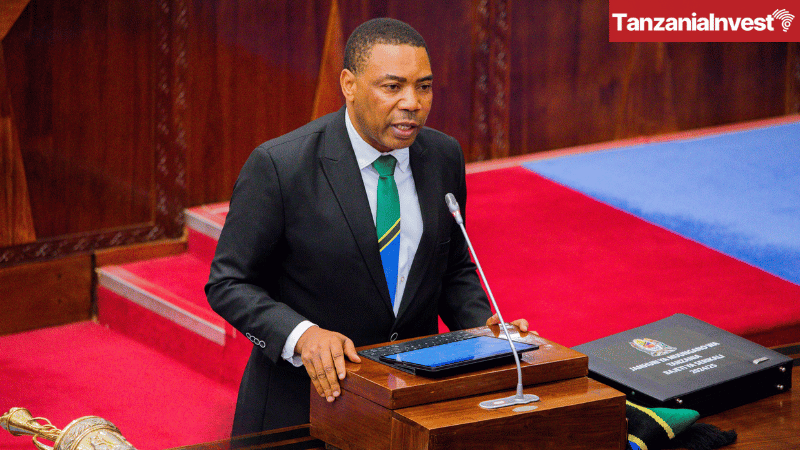

On 26 June 2025, Finance Minister Mwigulu Nchemba announced amendments to Tanzania’s TZS 56.49 trillion 2025/26 draft budget, including changes to the proposed withholding tax (WHT) on retained earnings and the postponement of several tax measures.

The changes follow feedback from the Tanzania Private Sector Federation (TPSF) and the Confederation of Tanzania Industries (CTI), and other stakeholders who expressed concerns about the impact of the 10% WHT on retained earnings and the timeline for distribution, as well as the effect of new levies and increased costs on business expansion, reinvestment, and competitiveness

The revised Finance Bill 2025, presented by Minister Nchemba, extends the period for the 10% WHT on retained earnings not distributed as dividends from the initially proposed six months to twelve months.

This adjustment aims to support businesses in reinvesting profits and to provide a more accommodating environment for growth.

Other changes in the revised bill include reducing the local government hotel levy from 10% to 2% and capping the service levy at 0.25%.

The industrial development levy (IDL) on clinker imports has been removed, and the proposed carbon levy of TZS 22,000 per ton on coal and natural gas has been withdrawn.

VAT exemptions have been expanded to include pesticides, fertilizers, locally produced edible oils, and compressed natural gas (CNG).

The mandatory USD 44 travel insurance for foreign visitors remains, but this requirement will not apply to residents from East African Community (EAC) and Southern African Development Community (SADC) countries.

Some proposed tax measures have been postponed to January 2026. The single installment income tax of 2% on the value of sales of forest products will commence on 1 January 2026. This measure aims to formalize the forestry sub-sector and expand the tax base.

Additionally, the industrial development levy on optical fibers, spaghetti, and starch will also begin to be charged from 1 January 2026.

Commenting on the postponement of certain measures, Minister Nchemba explained: “The government has taken into account the input from stakeholders and decided to provide additional time for implementation to ensure readiness in the affected sectors. These amendments reflect the commitment of the government to create an enabling environment for investment and business growth, while ensuring effective revenue collection.”

Next, the revised Finance Bill and Appropriation Bill will proceed to further parliamentary scrutiny for debate and possible final adjustments.

Following this stage, both bills are expected to be passed before the end of June 2025, allowing the approved 2025/26 Budget to take effect from 1 July 2025.

Disclaimer

While every effort has been made to ensure the accuracy of the information presented, TanzaniaInvest does not accept any liability for errors, omissions, or interpretations. Readers are advised to consult with qualified tax advisors or legal professionals before making any decisions based on the tax, legal, or financial frameworks discussed in this article.