The Bank of Tanzania (BoT) has released its mid-year review of the Monetary Policy Statement for 2024/25, highlighting Tanzania’s economic performance in 2024 and providing an outlook for 2025 and beyond.

Economic Performance in 2024

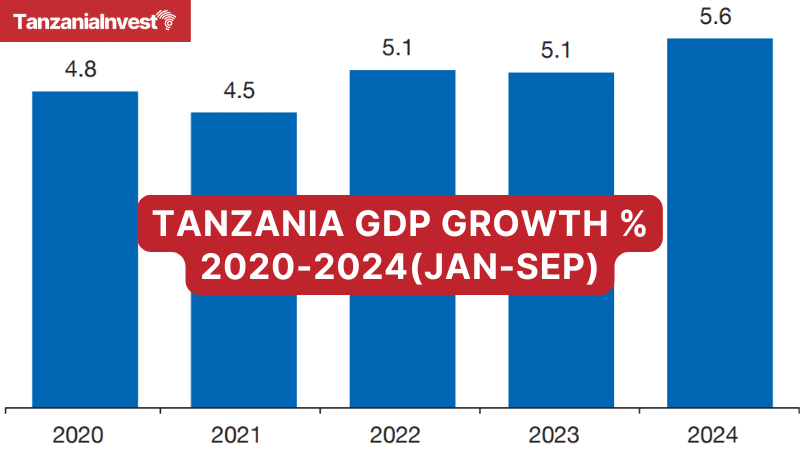

The economies of Mainland Tanzania and Zanzibar demonstrated strong performance. In Mainland Tanzania, the economy grew 5.6% in the first three quarters of 2024 and is estimated to grow 5.7% in the last quarter.

Therefore, growth for the entire year is estimated at 5.6%, slightly more than the projection of 5.4%.

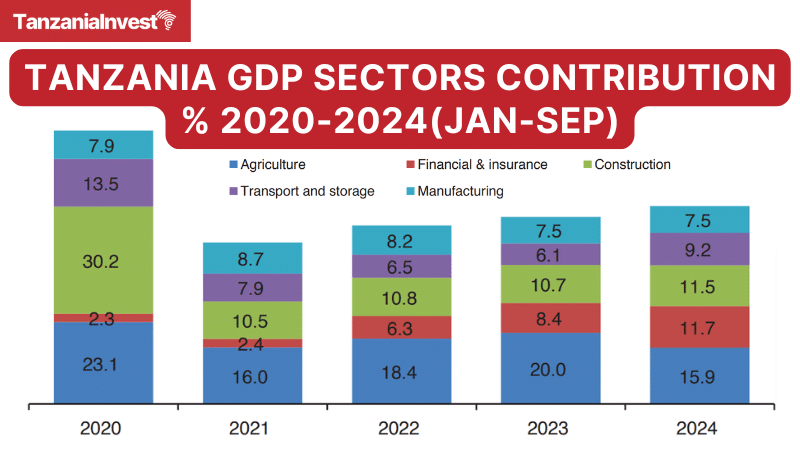

The growth was broad-based, driven mainly by agriculture, finance and insurance, transport, and construction activities.

Tourism, which cuts across many activities, also contributed to the growth through transport and storage, and accommodation and restaurant sectors.

The stability of power supply, favorable weather for agriculture, improved business environment, and prudent policies supported the observed performance in economic activities.

Agriculture was the largest contributor to the growth, accounting for 15.9%. A significant improvement was observed in the production of cash crops, particularly cashew nuts, tobacco, and cereals.

Procurement of cashew nuts was the highest ever recorded in the past five years, with farmers receiving good prices owing to the introduction of the online auction system by the Tanzania Mercantile Exchange.

Meanwhile, financial and insurance, electricity, and information and communication activities registered the highest growth rates.

In Zanzibar, the economy grew by 7%, supported by tourism, livestock, and construction activities. Compared to the same period in 2023, GDP growth was slightly higher, reflecting improved economic conditions and increased investment. The growth also exceeded previous projections for 2024.

Inflation remained stable at 3.1%, below the medium-term target of 5%. Contributing factors included prudent monetary and fiscal policies, stable food prices, and moderate global commodity prices. In Zanzibar, inflation eased to 5.1% from 6.5% in 2023.

The Central Bank Rate (CBR) was maintained at 6%, ensuring adequate liquidity in the economy. The private sector credit growth stood at 16.1%, with personal loans—particularly to SMEs—playing a key role. Interest rates on loans averaged 16%, while deposit rates were around 8%.

Money supply (M3) grew by 11.9% in the first half of 2024/25, mainly driven by private sector credit expansion.

External Sector Performance

Tanzania’s external sector improved, with the current account deficit narrowing to USD 785.3 million in the first half of 2024/25, almost half the deficit recorded in the previous year. This was supported by increased exports in tourism, gold, cashew nuts, and tobacco.

On an annual basis, total exports rose to USD 16.1 billion, accounting for 20% of GDP, up from 18% in 2023.

Compared to the first half of 2023/24, exports grew significantly, particularly in the tourism and gold sectors, benefiting from a recovery in global travel and strong commodity prices.

Foreign reserves remained adequate at USD 5.5 billion, covering 4.5 months of imports, similar to the levels observed in late 2023.

The exchange rate depreciated gradually in early 2024 but strengthened later in the year due to improved global economic conditions and increased foreign exchange earnings.

Foreign exchange liquidity, which was initially low, saw significant improvement in the latter half of 2024, helped by higher inflows from tourism, gold, and agricultural exports.

Fiscal Performance and Debt Sustainability

Domestic revenue collection met targets, driven by tax revenue and improved tax administration. Fiscal performance in Zanzibar exceeded expectations, with tax revenue surpassing targets by 3.6%.

Compared to the same period in 2023, revenue collection saw a notable increase, supported by expanded economic activity and improved compliance.

Public debt remained sustainable, with the debt-to-GDP ratio at 41.1%, well below the 55% threshold set by the IMF/WB Debt Sustainability Framework. The total public debt stood at USD 39.1 billion, with 65.2% being external debt.

The government’s budgetary performance remained strong, with expenditure aligned with revenue collection and public debt remaining at sustainable levels.

Interest rates remained stable, with market-determined rates aligning with the Central Bank’s policy framework. The financial sector remained stable, with banks maintaining adequate liquidity and capital levels while improving digital financial services and inclusion.

Outlook for 2025

Economic growth in Mainland Tanzania is projected to reach 6% in 2025, supported by agriculture, construction, transport and logistics. Zanzibar’s economy is expected to grow at over 6%, driven by tourism, construction, and real estate.

Inflation is forecast to remain around 3%, supported by prudent policies, stable exchange rates, and adequate food supplies. However, risks remain, including potential OPEC+ oil production cuts.

“The Bank will continue enhancing liquidity, improving interbank market operations, and promoting financial sector reforms to reduce lending rates and increase financial inclusion.”

The Central Bank of Tanzania

According to the Bank of Tanzania, “The monetary policy stance for the second half of 2024/25 will remain largely unchanged, focusing on stabilizing inflation and fostering economic growth. The Bank will continue enhancing liquidity, improving interbank market operations, and promoting financial sector reforms to reduce lending rates and increase financial inclusion.”