Gladiator Resources Limited (ASX:GLA) announced on September 9, 2025, that it is in discussions with multiple groups for the sale of its Tanzanian uranium assets.

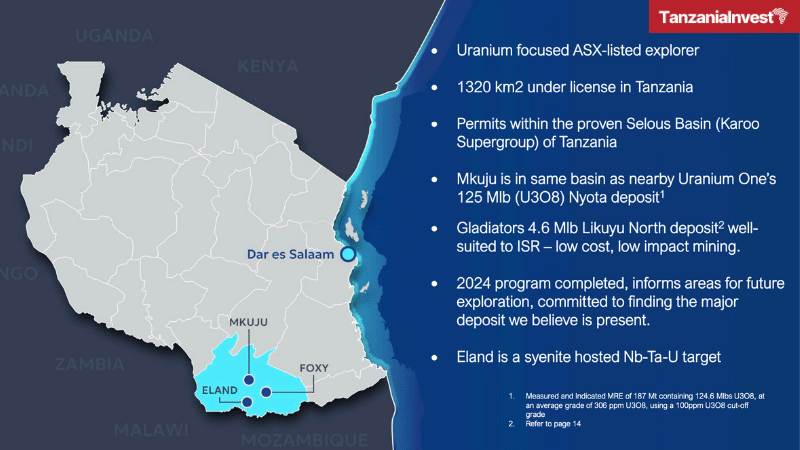

The assets under review include the South-West Corner, Mtyona, Likuyu North, and Foxy prospects within the Mkuju Uranium Project region in south-west Tanzania.

According to the company, interested parties have indicated that offers are expected in the coming months.

A transaction would strengthen Gladiator’s balance sheet and remove the need for near-term capital raising.

Gladiator explained that divesting its Tanzanian uranium portfolio would allow the company to focus on its U.S. rare earth assets.

The shift is intended to reposition Gladiator as a U.S.-focused rare earth company with the financial capacity to accelerate development and growth.

Gladiator Chairman Matthew Boysen said the review and discussions are part of the company’s broader strategy to crystallise near-term value in Tanzania while securing resources for expansion in the United States.

He added that shareholders would be updated in line with disclosure requirements, but cautioned that there is no certainty a transaction will occur.

The Mkuju Uranium Project

The Mkuju Urankum Project includes the Likuyu North deposit, the Likuyu South target and the Mtonya-SWC corridor within 4 contiguous permits totalling 725km2.

The tenements were previously owned by Uranex Limited, Western Metals Limited (WML), and Mantra Resources, who carried out exploration up until 2012. Gladiator acquired all available exploration data for the workup until 2012.

The area is underlain by sandstone-dominated formations of the Triassic-aged Lower Karoo Supergroup.

Gladiator’s assets are located near Uranium One’s Nyota Project, a major investment in Tanzania’s uranium sector.

Uranium One has committed over AUD 1.2 billion to Nyota, including the commissioning of a pilot uranium processing facility in July 2025.

The Nyota Project is expected to reach a production capacity of up to 3,000 tons of uranium per year, underscoring the region’s importance for future uranium supply.