Maendeleo Bank has received a national licence from the Bank of Tanzania (BoT), effective July 3rd, 2025, enabling the bank to expand its operations beyond its previous regional mandate.

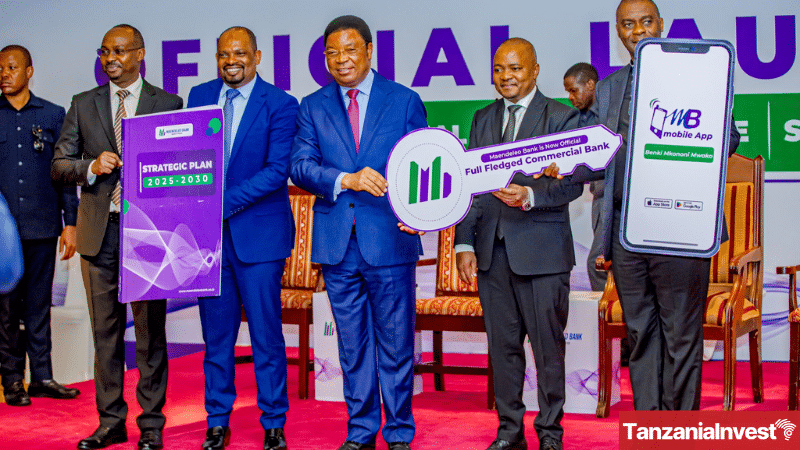

Prime Minister Kassim Majaliwa, speaking at the official launch of Maendeleo Bank’s new status as a full-fledged commercial bank in Dar es Salaam on July 3rd, 2025, urged the bank to build simple, affordable, and accessible banking systems, especially for ordinary citizens and small businesses.

Majaliwa called for the expansion of branch networks in underserved areas, including Zanzibar and rural mainland regions, and encouraged investment in digital platforms that can serve both smartphone and basic phone users.

He also advised the bank to work with other financial institutions to help strengthen the country’s overall financial sector.

For his part, Maendeleo Bank’s Managing Director, Lomnyaki Saitabau, explained that the change will make it easier for micro, small, and medium enterprises (MSMEs) to access credit, supporting key sectors for economic growth and job creation.

He added that, even as a commercial institution, the bank will continue to balance financial performance with its responsibility to serve all Tanzanians and promote wider financial inclusion.

Maendeleo Bank, established in 2013, was the first bank listed on the Enterprise Growth Market window of the Dar es Salaam Stock Exchange (DSE).

The bank started with a capital of TZS 4.5 billion and reached TZS 22.7 billion by the end of 2024.

As of 2024, the Bank’s assets totalled TZS 151.2 billion, customer deposits reached TZS 104 billion, and the loan portfolio stood at TZS 88.6 billion.

The bank operates five branches in Dar es Salaam and has over 2,300 agents in 11 regions, including Zanzibar.