On April 17, 2025, the International Monetary Fund (IMF) announced that it had reached a staff-level agreement with the Government of Tanzania on the fifth review under the Extended Credit Facility (ECF) and the second review under the Resilience and Sustainability Facility (RSF), enabling access to approximately USD 441 million in new financing, subject to Executive Board approval.

The agreement was reached following IMF staff consultations in Dar es Salaam from April 2 to 17, 2025.

Once approved, the agreement will unlock Special Drawing Rights (SDR) 326.47 million (approximately USD 440.8 million), bringing the total funding under the ECF arrangement to SDR 682.21 million (USD 907.4 million) and SDR 255.72 million (USD 343.6 million) under the RSF.

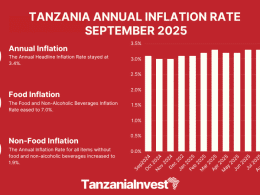

In its press release, the IMF indicates Tanzania’s economic performance remains strong. Real GDP growth reached 5.5% in 2024 and is projected to increase to 6% in 2025. Inflation remained low at 3.3% year-on-year in March 2025, below the Bank of Tanzania’s (BoT) target of 5%.

The current account deficit narrowed to 2.6% of GDP in calendar year 2024, down from 3.8% in 2023, due to strong exports of minerals and agricultural products and record tourism arrivals, while imports grew moderately. Gross international reserves stood at USD 5.7 billion in March 2025, equivalent to about 3.8 months of imports.

Regarding fiscal policy and monetary outlook, the IMF mission also noted that in FY2024/25, fiscal consolidation is expected to pause following a supplementary budget adopted in February 2025 that raised public spending by about 0.4% of GDP, targeting education, health, and domestic arrears.

In FY2025/26, authorities aim to reduce the domestic primary deficit to 0.8% of GDP through revenue measures yielding 0.9% of GDP, while maintaining social spending at 7.1% of GDP.

The IMF considers the current Bank of Tanzania rate (CBR) of 6% to be neutral or mildly stimulative, contributing to price stability. It also noted improvements in the functioning of the foreign exchange market, increased tolerance for exchange rate flexibility, and a narrowing of the parallel market premium due to reforms and FX policy adjustments.

The mission also addressed structural reforms and long-term development goals under the Article IV consultation.

These include improving access to finance, business environment, and strengthening anti-corruption and judicial institutions to support private-sector led growth.

Implementation of climate reforms under the RSF continues, with efforts to align public investment management with climate risks and improve institutional frameworks.

Technical and financial assistance from the IMF, World Bank, and other development partners will support these initiatives.

Mr. Nicolas Blancher, IMF Mission Chief for Tanzania, stated: “In the context of the Article IV consultation, the mission was also an opportunity to discuss longer-term prospects for the Tanzanian economy with a range of government and other counterparts. To meet the ambitious goals laid out in the Tanzania Vision 2050, it will be critical to ensure that sufficient resources are dedicated to the education and health of a young and rapidly growing population, and to create an enabling environment for private sector-led growth and job creation. In particular, further efforts to improve the availability and access to finance, streamline business regulations, and strengthen judicial and anti-corruption institutions are key structural reform priorities. Continuing the implementation of climate reforms, supported by the RSF, will enhance climate resilience and sustainability. The government has already started to strengthen the institutional framework for climate policies and public investment management in line with climate risks. Accelerating implementation of RSF reforms with technical and financial assistance from the IMF, the World Bank, and other development partners will help build resilience and catalyze support for the climate agenda in Tanzania.”