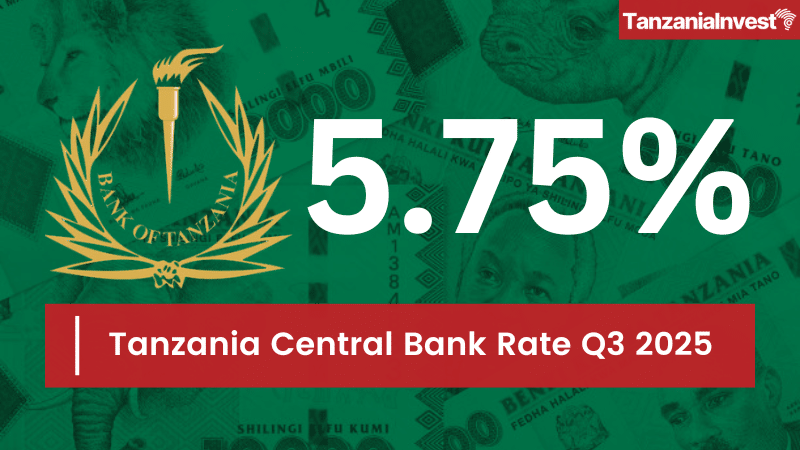

The Bank of Tanzania (BOT) Monetary Policy Committee (MPC) has decided to lower the Central Bank Rate (CBR) by 25 basis points, to 5.75% from 6.00%.

This decision reflects the Committee’s confidence in the inflation outlook. Inflation has consistently remained within the target band of 3–5%, and projections indicate it will remain stable within this range.

This is supported by prudent monetary and fiscal policies, the onset of the harvest season, and exchange rate stability.

While geopolitical tensions and tariff hikes have increased global uncertainty, recent negotiations and agreements suggest that risks may be moderating.

Consequently, BOT will implement monetary policy to ensure that the 7-day interbank rate stabilizes within the CBR corridor of 3.75-7.75%.

Economic Performances

The MPC also assessed domestic economic performance and observed that it has been steadily strengthening, buoyed by robust public infrastructure investment and rising private sector activity, underpinned by an improving business climate.

The risks to the outlook are minimal, due to the diversified structure of the economy and consistent implementation of growth-enhancing policies and programs, which are expected to cushion the economy against external shocks.

GDP

The domestic economy continued to demonstrate resilience and sustained improvement.

According to estimates conducted in June 2025, GDP growth for Mainland Tanzania reached 5.8% and 5.5% in the first and second quarters of 2025, respectively. This growth was primarily driven by robust performance in agriculture, construction, and financial services, and is forecasted to reach 6.0% and 6.9% in the third and fourth quarters, respectively.

The Zanzibar economy is expected to follow a similar pattern. The momentum is largely supported by substantial infrastructure investments in railways, roads, airports, and sports facilities in preparation for the upcoming CHAN and AFCON tournaments, as well as continued investment in agriculture and mining.

This optimistic outlook is reinforced by the findings of the Market Perception Survey and the CEOs Economic Perception Survey conducted in May 2025.

Investor confidence also remains strong, as reflected in the Fitch Ratings announced in June 2025, which affirmed Tanzania’s credit rating at B+ with a stable outlook.

Inflation

Headline inflation in Mainland Tanzania averaged 3.2% in the second quarter of 2025, reflecting the impact of prudent monetary policy and subdued price movements in non-food and energy-related items.

However, food inflation experienced a temporary uptick, driven by transportation disruptions caused by heavy rainfall in certain regions. Core inflation eased, supported by a moderation in service prices, particularly recreation, sports, and culture, as well as house maintenance.

In Zanzibar, headline inflation declined to 4.2% in May 2025 from 5.3% a year earlier, largely due to lower food prices.

Money Supply

Money supply (M3) continued to expand moderately, reflecting the increasing needs of economic activities. In the second quarter of 2025, M3 is estimated to have grown at an average annual rate of 19.1%, from 15.4% in the preceding quarter. This expansion was largely driven by robust private sector credit growth of 16.7%, reflecting the easing of financial conditions and improving business environment.

The financial sector remained sound and resilient. The banking sector remained liquid, profitable and adequately capitalized. Growth in deposits and lending was further supported by the continued expansion of agent banking networks, advancements in digital financial services and the diversification of financial products.

The ratio of non-performing loans (NPLs) declined to 3.4% in May 2025, remaining well below the prudential threshold of 5%, signaling improved credit quality and risk management practices in the banking sector.

Fiscal Performance

Fiscal performance in both Mainland Tanzania and Zanzibar supported monetary policy operations. Revenue collections were on target, underpinned by enhanced tax administration and improved compliance. Expenditure execution was well-aligned with available resources, reflecting continued commitment to prudent fiscal management.

The MPC observed that the ongoing implementation of fiscal consolidation and reforms will facilitate sustainable growth and complement monetary policy in ensuring low and stable inflation. Public debt increased moderately and remained sustainable, with a moderate risk of debt distress.

External Sector

The external sector continued to strengthen during the second quarter of 2025, with the current account deficit estimated to have narrowed to USD 797.1 million from USD 872.1 million in the second quarter of 2024.

For fiscal year 2024/25, the current account deficit is estimated at 2.6% of GDP, an improvement from 3.7% recorded in the previous year. This improvement reflects strong performance in exports of gold, tourism, cash crops and manufactured goods.

Zanzibar also recorded a notable external sector performance, posting a current account surplus of USD 611.1 million in 2024/25, from USD 428.5 million in the previous year, underpinned by robust tourism receipts.

Foreign exchange reserves increased, reaching about USD 6 billion at the end of June 2025, one of the highest in recent years. This level is sufficient to cover about 4.8 months of projected imports of goods and services. The outlook for the external sector remains favourable, supported by anticipated seasonal peaks in exports, particularly in tourism, gold, and cash crops.

Forex

The Tanzanian shilling was stable against major trading currencies. It depreciated at a slow pace of 0.2% against the US dollar in the year ending June 2025, compared with a depreciation of 12.5% in the year ending June 2024. This stability is primarily supported by improved foreign exchange liquidity, bolstered by increased tourism earnings, strong exports, particularly from gold, and tobacco.

In addition, the Bank of Tanzania’s prudent monetary policy and the enforcement of regulations that require payment in shillings for domestic transactions also contributed the most. Furthermore, increased domestic gold purchases for reserve accumulation contributed to improved confidence in the local currency.

The MPC will convene again on 1st October 2025, and the announcement of CBR will be on 2nd October 2025.