Citizenship planning firm Henley & Partners has released, in partnership with South African wealth intelligence firm New World Wealth, The Africa Wealth Report 2025.

The report highlights the continent’s wealthiest countries and cities, alongside expert insights on economic mobility and investment migration.

According to the report, Africa’s millionaire population is projected to grow by 65% over the next decade.

The continent is currently home to 25 billionaires, 348 centi-millionaires, and 122,500 millionaires—a remarkable transformation from the late 20th century, when there were only a few billionaires and many African economies were in long-term decline.

Dominic Volek, Group Head of Private Clients at Henley & Partners, says Africa’s sustained economic expansion, combined with significant growth in high-net-worth-individual (HNWI) populations, positions the continent as a key player in the evolving global wealth landscape.

“The investment migration sector is now working both ways, with African investors seeking greater global mobility and diversification while international investors are increasingly identifying Africa as a destination for long-term, stable capital deployment.”

Africa’s Wealthiest Countries and Cities

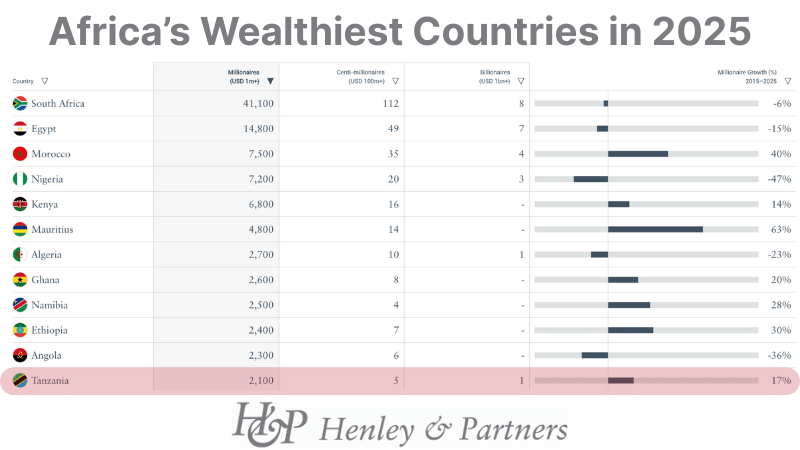

South Africa now accounts for 34% of Africa’s millionaires—roughly equal to the next five wealthiest countries combined—and with 41,100 millionaires.

It leads Africa’s Big 5 wealth markets, which include Egypt (14,800 resident millionaires), Morocco (7,500), Nigeria (7,200), and Kenya (6,800), collectively representing 63% of the continent’s millionaires and 88% of its billionaires.

Mauritius, the 6th wealthiest country in Africa, has recorded the continent’s strongest HNWI growth over the past decade at +63%, driven largely by its political stability, tax efficiency, and a robust residence-by-investment program.

Rwanda (+48%) and Morocco (+40%) have also posted strong gains, while Nigeria’s millionaire population has contracted sharply by -47%, with Angola (-36%) and Algeria (-23%) likewise in decline.

At the city level, with 11,700 resident millionaires, Johannesburg holds onto the top spot as Africa’s wealthiest city, anchored by the Sandton business district and luxury residential enclaves in the up-and-coming Waterfall–Midrand area.

However, Cape Town, placed 2nd with 8,500 HNWI, has emerged as the continent’s leader in centi-millionaires, with 35 super wealthy individuals calling it home.

The “Mother City” is also Africa’s most expensive prime real estate market at USD 5,800 per m² and is on track to overtake Johannesburg in total wealth by 2030.

Cairo ranks 3rd with 6,800 HNWI and has the highest concentration of billionaires in Africa, with 5 in residence, while East Africa’s economic powerhouse, Nairobi, in 4th place, has 4,200 millionaires, accounting for almost half of Kenya’s total private wealth.

Africa’s Fastest Growing Millionaire Hotspots

Several wealth hubs have far outpaced continental averages. The Black River district in Mauritius tops the list with 105% millionaire growth over the past decade, followed by Marrakech (+67%), and South Africa’s Whale Coast (+50%).

The Cape Winelands region (+42%), encompassing Stellenbosch, Franschhoek, and Paarl, continues to attract wealthy retirees and second-home buyers, supported by strong lifestyle and education credentials. Cape Town (+33%) rounds out the Top 5.

Looking to the future, Head of Research at New World Wealth, Andrew Amoils, says the increase in Africa’s millionaire population will likely be led by lifestyle destinations such as the Whale Coast, Cape Winelands, and Marrakech.

According to him, the main industries expected to drive this growth include fintech, eco-tourism, software development, green tech, e-commerce, rare metals mining, healthcare, biotech, media, entertainment, and wealth management.

With the EU and UK becoming less attractive among the global jet-set, there is potential for Africa to emerge as a major destination for wealthy entrepreneurs. There are already signs of this happening, with Morocco, Mauritius, Namibia, and Seychelles all projected to see big wealth inflows this year.

Africa’s Mobility

Exclusive research published in Henley & Partners’ January 2025 Global Mobility Report confirmed systemic visa discrimination against Africans in Europe.

Led by Prof. Mehari Taddele Maru at the Migration Policy Centre at the European University Institute, the study found that while globally only one in six Schengen visa applications is rejected, one in two African applicants is turned away—a rate that has more than doubled over the past decade.

The Henley Passport Power Index underscores the economic cost of this inequality, revealing how African citizens’ limited travel freedom curtails their access to global markets, talent networks, and international GDP.

In response, a growing number of affluent Africans are adopting a proactive strategy of “global positioning” by acquiring alternative residence rights and citizenships as a tool to expand business reach, secure international educational opportunities for their children, and safeguard family wealth.

Portugal’s Golden Residence Permit Program remains the top choice for African investors, followed by citizenship programs in Grenada and Antigua and Barbuda, as well as Latvia’s Residence by Investment Program.

On the inbound side, Egypt, Mauritius, and São Tomé and Príncipe are using investment migration to attract long-term foreign capital without increasing sovereign debt.

Capital, Climate, and the Case for Africa

Africa’s investment narrative is increasingly shaped by innovation and sustainability. Google’s recently announced USD 25 million African food security and AI initiative underscores rising global interest in funding the continent’s small and medium enterprises, which account for 80% of jobs but often lack access to capital.

Commenting in the Africa Wealth Report 2025, Nontobeko Ndhlazi, Group Chief Financial Officer at WIPHOLD, says Africa has the youngest population in the world, which poses a powerful advantage if properly harnessed.

According to him, the full potential of this social dividend, where approximately half of Africa’s youth are women, holds immense possibilities. African women, particularly those in rural areas, play a crucial role in the broader agricultural sector. Many have developed an inherent understanding of environmental sustainability, making them de facto environmental managers.

With Africa generating less than 4% of global carbon emissions but suffering disproportionately from climate change impacts, there is growing scope for investment migration frameworks to fund climate adaptation and green infrastructure, such as Nauru’s Economic and Climate Resilience Citizenship Program. Countries that integrate renewable energy, sustainable agriculture, and resilience projects into their investment migration offerings can secure both economic and environmental gains.

Jean Paul Fabri, Chief Economist at Henley & Partners, concludes that the rise in Africa’s millionaire class is both a signal and a test. It signals that despite challenges, wealth is being created and retained in key markets. But it also tests the continent’s ability to turn private wealth growth into a broad-based economic transformation.

For Africa, the goal is not merely to count millionaires, but to build a wealth ecosystem where prosperity is self-reinforcing. Where opportunity expands, capital circulates locally, and the continent becomes not just a participant, but a leader, in the global wealth story.

Tanzania’s Ranking & Findings

According to the report, Tanzania is Africa’s 12th wealthiest countries, and 3rd in East AAfrica after Kenya and Ethipia.

Tanzania has a total of 2,100 millionaires with USD 1m+, 5 centi-millionaires (USD 100m+), and 1 USD billionaire (Mohammed Dewji–the only one in East & Central Africa).

The country has experienced 17% growth in USD millionaires between 2015 and 2025, way above the continent’s negative average of -5%.