The 2025 Chandler Good Government Index (CGGI) has been released, assessing 120 countries on government capabilities and effectiveness.

Published annually by the Chandler Institute of Governance by the Chandler Institute of Governance, an international non-profit organization based in Singapore, the index evaluates countries across seven pillars and 35 indicators.

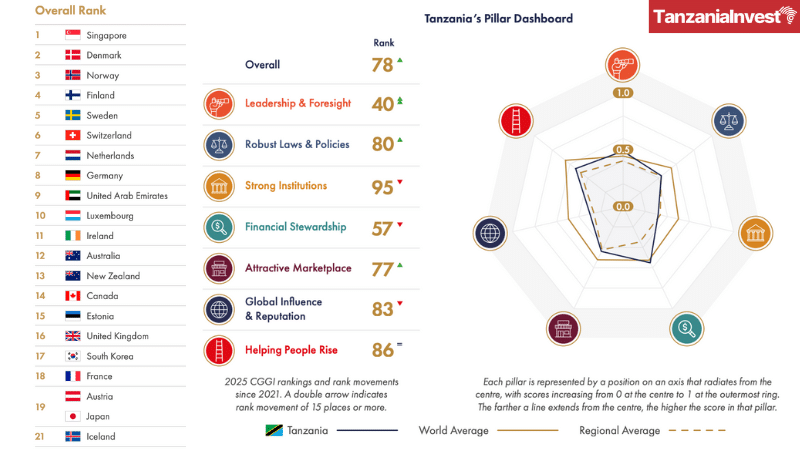

These pillars include Leadership & Foresight, Robust Laws & Policies, Strong Institutions, Financial Stewardship, Attractive Marketplace, Global Influence & Reputation, and Helping People Rise.

The CGGI 2025 report examines global governance trends, highlights improvements and declines in performance, and provides case studies of nations including Tanzania, Vietnam, Lithuania, Jamaica, and the United Arab Emirates.

The report also discusses key challenges such as fiscal reforms, digital transformation, anti-corruption efforts, and workforce development.

Global Governance Ranking

Singapore once again tops the CGGI in 2025, retaining its position for the fourth time since the index’s launch in 2021. The rest of the top five are Denmark (2nd), Norway (3rd), Finland (4th), and Sweden (5th).

The United Arab Emirates entered the top ten, rising from 14th place in 2024 to 9th in 2025.

European countries dominated the top 20, occupying 13 of the positions, with Australia, Japan, New Zealand, and South Korea also maintaining strong rankings.

Governance in Africa

The CGGI 2025 covers 28 African countries with a combined population of about 1.16 billion.

Mauritius remains the highest-ranked African country at 51st, followed by Rwanda, Botswana, Morocco, and South Africa.

The report notes that Africa continues to face governance challenges, with the lowest average regional score, though modest improvements were recorded between 2024 and 2025.

Regional performance across the pillars shows improvements in Strong Institutions but declines in Financial Stewardship, Global Influence & Reputation, and Helping People Rise, with Financial Stewardship recording the steepest and most sustained decline due to debt burdens and fiscal pressures.

Between 2021 and 2025, only two countries in Africa improved their overall rankings—Tanzania and Rwanda—while the rest declined.

Tanzania’s Performance

Tanzania is ranked 78th in CGGI 2025, up from 82nd in 2021, making it the most improved country in Africa over the past five years.

Tanzania recorded notable gains in the Leadership & Foresight pillar, ranking 40th globally.

Its performance across the seven pillars in 2025 is: Robust Laws & Policies (78th), Strong Institutions (80th), Financial Stewardship (95th), Attractive Marketplace (57th), Global Influence & Reputation (77th), and Helping People Rise (83rd).

The report highlights the Tanzanian government’s increasing adoption of new policy solutions and reform strategies. Initiatives such as the Digital Tanzania Project and the Data Protection Act are enhancing efficiency, service delivery, and security in the digital space.

Tanzania has also consolidated its strategic ties with countries including Egypt, France, and Türkiye, boosting international confidence. Foreign and domestic investment rose 21.6% to USD 6.56 billion in the fiscal year ending June 2024.

Key Factors Driving Tanzania’s Progress

In the report, Sakina Bakari Mwinyimkuu, Director of Performance Monitoring & Evaluation in the Prime Minister’s Office, identified key factors driving Tanzania’s progress:

Good and Stable Leadership: President Samia Suluhu Hassan, in office since 2021, has promoted reforms to improve transparency, restore democratic practices, and enhance relations with communities.

Unity and Stability: Tanzania’s cultural cohesion and the use of Swahili as a common language support political stability and consensus-building.

The “4Rs” Philosophy: Reconciliation, Resilience, Reforms, and Rebuilding guide government action.

Structural Reforms: Establishment of the Planning Commission through the Planning Commission Act of 2023, and creation of a Division of Performance Monitoring & Evaluation to track government programs and projects.

Strategic Planning: Preparation of a new national vision 2050, to be completed by June 2026, alongside monitoring of five-year development plans.

Coordination Across Government: Strong coordination between ministries and institutions, with the Prime Minister’s Office centralizing oversight.

Digitalization: Introduction of a government performance dashboard to consolidate reports and citizen inputs with minimal human intervention.

Strengthening Laws and Institutions

Tanzania has invested in judicial reforms by training judges, magistrates, and court staff, particularly in commercial, environmental, and human rights law. Digital case management systems now allow citizens to track cases online, reducing delays and backlog.

The Mama Samia Legal Aid Campaign, launched in April 2023, has reached 25 out of 26 regions, providing legal support to over 2 million citizens. Ongoing legal reforms include updating land laws to address disputes and improve property rights, particularly for women in marginalized groups.

Transparency and accountability have been promoted through the release of public reports on projects in water and health, alongside monthly media sessions to share government progress with citizens.

Building an Attractive Marketplace

Tanzania continues to invest in major infrastructure projects to enhance competitiveness and production capacity. These include the Julius Nyerere Hydropower Station, expected to be completed in 2025, the East Africa Crude Oil Pipeline, and the standard gauge railway linking Dar es Salaam to Mwanza.

Government services are also being digitalized, with platforms such as the e-Immigration Portal reducing delays and curbing corruption in services like passport processing.

Remaining Challenges

Despite progress, challenges persist. Public sector efficiency at the local government level remains weak, affecting over 70% of the population.

Corruption and nepotism are still concerns, though increased use of technology is limiting opportunities for malpractice.

Youth unemployment and reliance on traditional agriculture pose further challenges, requiring diversification and industrialization in sectors such as agro-processing, textiles, and technology.

Oversight mechanisms are being reinforced, with new accountability frameworks and performance monitoring tools to ensure government projects are implemented effectively.