On 13th June 2025, Fitch Ratings reaffirmed Tanzania’s Long-Term Foreign-Currency Issuer Default Rating (IDR) at ‘B+’ with a Stable Outlook.

The decision reflects the country’s relatively strong real GDP growth and low inflation, underpinned by reforms and access to external financing under the current IMF programme.

However, the rating is constrained by weak governance indicators and low government revenue relative to ‘B’ category peers, and a weak macroeconomic policy framework that leads to distortions in the FX market.

Political Tensions to Rise

Political tensions are increasing ahead of the October 2025 general election, driven by arrests of opposition members tied to reform efforts, though President Samia is expected to remain in power, ensuring policy continuity and avoiding major unrest.

Wider Fiscal Deficits

The government raised its FY25 deficit forecast to 3.3% of GDP through a February 2025 supplementary budget that boosts social and capital spending, following a FY24 deficit of 3% due to revenue shortfalls, with revenue expected to rise gradually but remain below peer medians.

Higher Interest Costs

Central government interest expenses are projected to increase to 16% of revenue in FY25 due to costlier domestic borrowing, despite 70% of external debt being concessional and 60% of FY25 financing expected to come from foreign concessional loans.

FX Buffers Below Peers

Foreign exchange reserves declined due to interventions and debt servicing but slightly recovered to USD5.7b in March 2025, with projections of USD5.6b by year-end, equal to 3.2 months of external payments, below the 4.5-month ‘B’ median.

Challenges in Policy Framework

Despite IMF-supported reforms including a shift to interest-rate targeting and FX policy changes, Tanzania’s macroeconomic framework remains constrained by liquidity management issues, FX market distortions, and persistent dollarisation.

Strong Growth to Continue

Fitch forecasts GDP growth at 5.9% in 2025, up from 5.5% in 2024, supported by gains in agriculture, mining, tourism, and infrastructure projects, with further upside from planned LNG development.

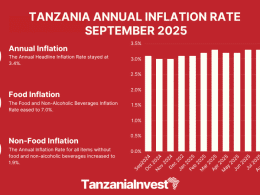

Low Inflation

Inflation remains within target, averaging 3.2% in 4M25, with forecasts of 3.6% for 2025 and 4% in 2026, while the BoT is expected to hold the policy rate at 6% due to election-related spending and FX risks.

Improving Public Financial Management

Verified arrears fell to 0.4% of GDP by March 2025 from 1.2% at end-2022, and no new arrears are anticipated as authorities commit to further reductions and securitisation of pension arrears by FY29.

High Concessional Debt

Debt is projected to reach 49% of GDP by FY26 from 46% in FY23, aligned with peer medians, and remains sustainable due to a still-high share of concessional loans, although this share will decline as Tanzania adjusts to its middle-income status.

ESG – Governance

Tanzania scores ‘5’ on governance-related ESG indicators due to moderate World Bank rankings, reflecting gains in government effectiveness and corruption control, despite ongoing institutional and accountability gaps.

For more details, visit Fitch Ratings commentary.