As of 9th June 2025, Tanzania collected a record TZS 1.028 trillion in dividends and contributions for the financial year 2024/2025 from 213 companies in which the government holds shares—195 public institutions and 18 minority-owned companies.

This marks the highest amount ever collected by the government and represents a 68% increase compared to the previous year’s TZS 767 billion.

Out of the total TZS 1.028 trillion, 59% came from profit-making entities as dividends, 35% from the 15% contributions of companies’ gross revenues, and the remaining 6% from other sources including loan repayments, interest on on-lent funds, and fees from the advanced telecommunications traffic monitoring system (TTMS).

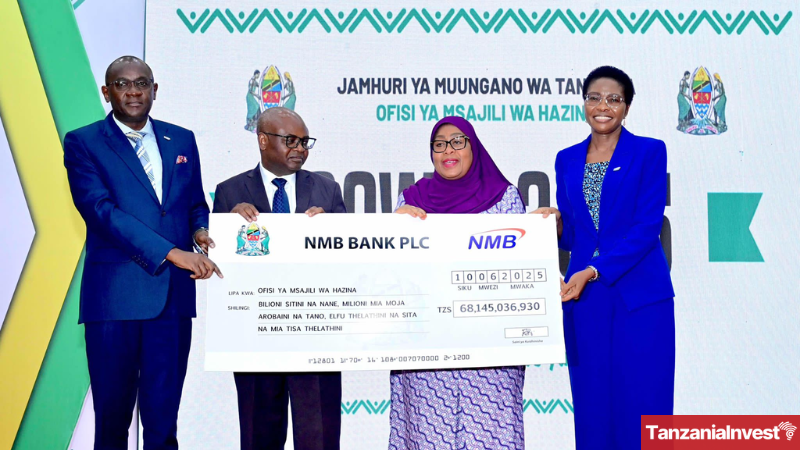

The data was disclosed by Tanzania’s Treasury Registrar Nehemiah Mchechu during the official Dividend Day ceremony held at the State House in Dar es Salaam on 10th June 2025, officiated by President Samia Suluhu Hassan.

During the event, 14 institutions were awarded for their performance in dividend contribution and governance reform across sectors including banking, energy, ports, housing, and health.

Entities recognised included NMB Bank, National Bank of Commerce (NBC), Puma Energy, Tanzania Agricultural Development Bank (TADB), Tanzania Ports Authority (TPA), Tanzania Shipping Agencies Corporation (TASAC), Tanzania Electric Supply Company (TANESCO), Tanzania Petroleum Development Corporation (TPDC), Airtel Tanzania, Tanzania Communications Regulatory Authority (TCRA), National Housing Corporation (NHC), and the National Identification Authority (NIDA).

In the first category, which recognised the largest dividend payers, Twiga Minerals Corporation led with TZS 93.6 billion, followed by Airtel Tanzania at TZS 73.9 billion, and NMB Bank Plc at TZS 68.2 billion.

NMB Bank increased its dividend from TZS 16 billion to TZS 64 billion, while NBC’s contributions rose from TZS 1.3 billion to TZS 10 billion.

The second category highlighted institutions contributing 15% of gross revenue, with TPA leading at TZS 181.1 billion, followed by NIDA at TZS 38.8 billion and the Tanzania Forest Services Agency (TFS) at TZS 29.8 billion.

The third category focused on institutions with the highest year-on-year growth in contributions.

TPDC doubled its contributions, while National Housing Corporation (NHC) grew by 363% and TADB by 285%, attributed to improved business models and operational efficiency.

The fourth category honoured entities that have contributed consistently for five consecutive years.

These included TCRA, TASAC, and the Business Registrations and Licensing Agency (BRELA).

The fifth category recognised transformed institutions that moved from persistent losses to profitability.

Tanzania Zambia Mafuta (TAZAMA) Pipeline was the standout performer, turning around after over ten years of losses to post a TZS 6.6 billion dividend, representing a 1,214% increase over five years.

The sixth category recognised the Bank of Tanzania (BoT) for its unique contribution to the Government Consolidated Fund and its role in macroeconomic and fiscal stability.

Speaking at the event, Mchechu reported that the collection included TZS 603.4 billion in dividends from profit-making state-owned enterprises, TZS 363.4 billion from non-commercial public institutions, and TZS 21 billion from other sources.

He noted that the number of contributing institutions rose to 213 as of 9th June, up from 145 in 2024, marking a 47% increase.

Mchechu added that further contributions are expected before the end of the fiscal year on 30th June 2025 and that the current figure is likely to increase.

He attributed the growth in collections to reforms under President Samia’s 4Rs philosophy and increased institutional accountability.

President Samia credited the record collection to public institutions’ implementation of her directives to boost productivity and efficiency.

She emphasized the government’s goal of reducing reliance on subsidies and transforming state-owned enterprises into financially viable entities that contribute to the national budget.

She explained that the TZS 1.028 trillion in contributions relieves budgetary pressure and demonstrates the impact of ongoing reforms.

She added that the government aims to reach at least TZS 1.5 trillion in the next fiscal year and instructed the Treasury Registrar to set clear revenue targets for each institution.

President Samia also called for deeper reforms, enhanced performance monitoring, and the adoption of digital tools and capital markets.

She confirmed the operational launch of a real-time performance monitoring dashboard for state-owned enterprises and instructed the Ministry of Planning and Investment to finalise the new Public Investment Law.

The law will provide a clearer legal framework for managing state investments and establish a sovereign investment fund.

Tanzania’s Minister for Planning and Investment, Prof. Kitila Mkumbo, reiterated the central role of state-owned enterprises in delivering infrastructure and services essential to national development.

Mkumbo noted that institutions like TANESCO, TPA, and TRC are key to the implementation of development strategies.

Tanzania State-Owned Enterprises

State-owned enterprises (SOEs) play a critical role in Tanzania’s economy, operating in key sectors such as banking, energy, transportation, housing, and healthcare.

These entities provide essential public services and infrastructure while representing significant public investments through which the government seeks to generate financial returns.

Government ownership in companies is managed through the Office of the Treasury Registrar (OTR), which oversees two categories of investments: Public and Statutory Corporations (PSCs), where the government holds majority or full ownership, and Minority Interests (MIs), where it holds partial shares. These investments are held in trust for the President of the United Republic of Tanzania.

According to government data, the total value of public investment in these enterprises rose from TZS 65 trillion in 2020 to TZS 86.29 trillion in 2024.

However, the National Audit Office’s Annual General Audit Report for the financial year 2023/24 assessed 217 public entities and confirmed recurring financial losses, liquidity constraints, governance weaknesses, and delays in implementing audit recommendations. The losses were primarily driven by poor operational and investment performance, weak expenditure controls, and ineffective revenue-generation strategies.

To improve oversight and ensure greater accountability from these institutions, Dividend Day was institutionalised in 2023 as an annual mechanism to assess the financial performance of SOEs and benchmark their contributions to national revenue.