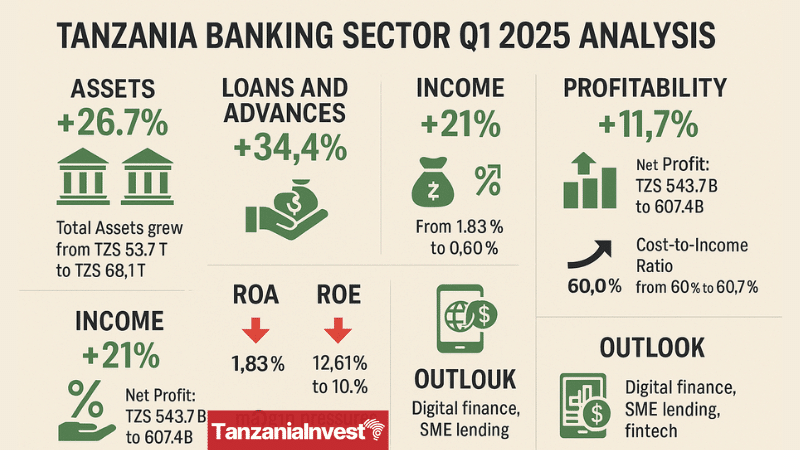

Tanzania’s banking sector continued its growth momentum in Q1 2025, with total assets increasing by 26.7% to reach TZS 68.1 trillion, according to a performance review by Reginald Massawe, Managing Director of AML Finance Limited.

Asset and Credit Growth

Total banking sector assets grew from TZS 53.7 trillion to TZS 68.1 trillion (+26.7%).

This was driven by a 34.4% increase in loans and advances, supported by strong credit demand in sectors including trade, agriculture, and infrastructure.

The expansion was facilitated by supportive monetary policy and improved liquidity positions among lenders.

Revenue Composition and Growth

Interest income increased by 21.4%, in line with the expansion of the loan portfolio.

Non-interest income rose by 20.4%, reflecting growing revenue from fees, commissions, and digital services.

However, total income growth lagged behind asset growth, suggesting narrowing net interest margins and underscoring the need for improved pricing strategies and cost controls.

Profitability and Cost Efficiency

Aggregate net profit rose by 11.7% from TZS 543.7 billion to TZS 607.4 billion.

Despite this, profitability weakened: Return on Assets (ROA) declined from 1.83% to 0.80%, and Return on Equity (ROE) fell from 12.61% to 10.8%.

The average Cost-to-Income Ratio (CIR) increased from 60.0% to 60.7%, primarily due to an 18.6% increase in staff costs.

Smaller banks reported CIRs exceeding 80%, highlighting structural inefficiencies and operational cost pressures.

Asset Quality

The Non-Performing Loan (NPL) ratio improved from 6.7% to 5.2%, attributed to improved credit restructuring, post-COVID recovery measures, and stricter loan monitoring.

However, some institutions still face elevated NPL levels, indicating ongoing challenges in risk assessment and portfolio quality.

Productivity, Staffing, and Competition

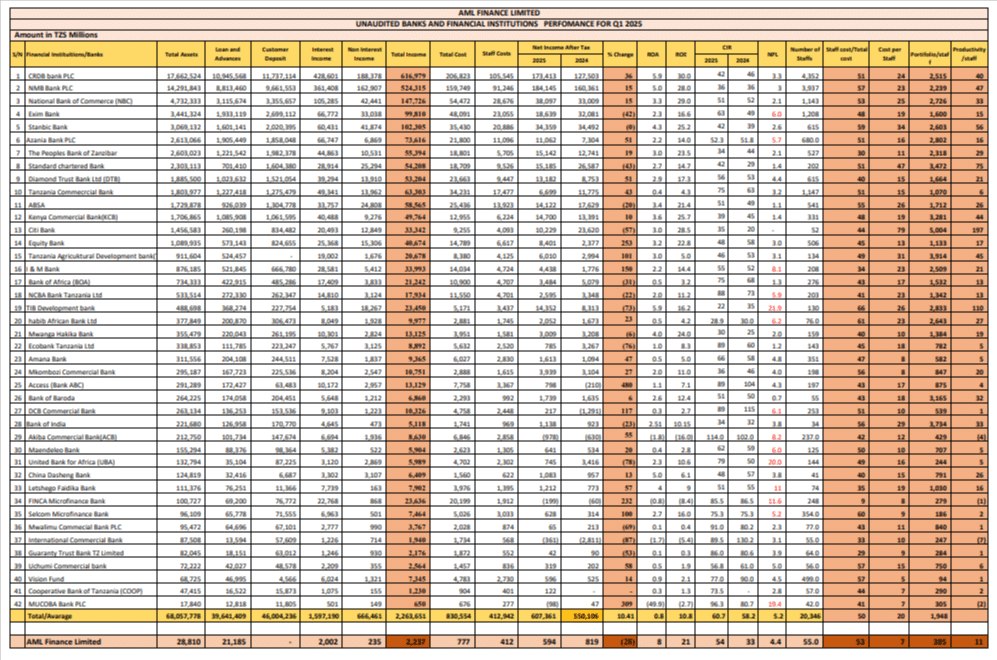

Tier 1 banks such as CRDB, NMB, and NBC continued to grow, supported by digital scale, institutional strength, and diversified portfolios. However, profitability pressures remained.

Mid-sized banks, including Stanbic, Exim, and PB,Z experienced increased cost pressures and tighter margins.

Small and niche banks such as Akiba, DCB, and Mwalimu recorded CIRs above 100%, lacked scale advantages, and in some cases, posted operational losses.

Portfolio per staff rose slightly to TZS 1.95 billion.

Still, productivity remains low, especially among smaller institutions, due to outdated systems, limited automation, and underinvestment in staff development.

According to the 2024 Productivity Worldwide report, Tanzania’s average labour productivity is USD 2.8/hour, far below the global average of USD 70–140/hour.

The productivity gap is attributed to institutional capabilities rather than resource limitations.

Tanzania Bank Performance Q1, 2025

Source: Published unaudited financial statement, March 2025, in various newspapers and website.

Strategic Outlook

According to Reginald Massawe, Tanzania’s banking sector is maturing, with continued asset growth and innovation offset by inefficiencies in cost structures and productivity.

Going forward, credit growth may moderate as liquidity conditions tighten and risk aversion increases.

Profitability pressure is expected to persist, particularly for undercapitalized or cost-heavy banks.

Opportunities exist in the expansion of digital financial services, fintech partnerships, and emerging segments such as SME and green finance.

Massawe noted that for AML Finance, the strategy is to enhance operational efficiency, strengthen credit risk systems, and improve productivity through digital integration, talent development, and cost discipline.

The institution aims to position itself as a high-performing, tech-driven bank with sustainable earnings and strong asset quality by year-end 2025.