According to the recently published African Economic Outlook 2020 report by the African Development Bank (AfDB), Tanzania will see a drop in its GDP growth to 5.2% in 2020 and 6.3% in 2021, from the pre-COVID–19 estimates of 6.4% and 6.6%.

These estimates assume that the COVID–19 outbreak is contained by the third quarter of 2020, though it is expected to induce various negative macroeconomic effects to the Tanzanian economy, transmitted primarily through travel and tourism, commodity prices, trade, and foreign direct investment (FDI).

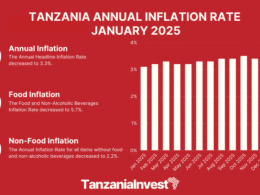

Inflation is expected to increase as the disruption in imported food supply chains due to travel restrictions and the depreciation of the shilling on account of lower export and tourism receipts offset lower domestic demand. Reduced export earnings and FDI inflows are expected to further depreciate the shilling and contribute to a buildup in inflation.

The fiscal deficit is projected to widen as tax revenues fall with lower trade, travel, and tourism activity amid increased public spending to contain the pandemic and interventions to support the most vulnerable population and affected businesses.

The current account deficit is also expected to weaken to 4.6% of GDP in 2020 in the baseline scenario, compared with the pre-COVID–19 estimate of 4%.

This is due to lower exports, particularly service export receipts following the reduction in travel and tourism, which is expected to more than offset the benefits of higher gold prices and lower global oil prices. Gold is Tanzania’s top export commodity and accounted for 29.25% of total exports in 2019.

However, the spike in gold prices and lower oil import bill may be inadequate to offset the reduction in overall merchandise exports and service receipts.

Furthermore, FDI inflows, which accounted for 2.2% of GDP in 2017, are expected to decline as investors defer investment decisions due to great uncertainty.

The government is implementing a monetary stimulus through reductions in the minimum reserve requirement from 7% to 6% and in the central bank discount rate from 7% to 5%.

In addition, a loan repayment moratorium was put in place for borrowers experiencing financial difficulties.

However, the AfDB indicates that a fiscal stimulus package will also be necessary and could include reductions in tax rates to increase disposable income and protect businesses.

Fiscal consolidation with a focus on expenditure rationalization will preserve macroeconomic stability. Strengthening public health system preparedness in the short term—and improving healthcare infrastructure in the long term through hiring more health workers, investing in modern laboratories, and expanding hospital bed capacity—remain critical, the bank concludes.