The Central Bank of Tanzania (BOT) has just published its Annual Report 2018-19, which entails an overview of the implementation of monetary policy, and a comprehensive overview of the domestic economy.

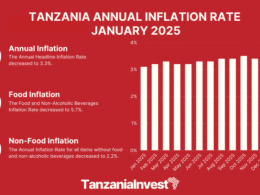

In the foreword, Governor Prof. Florens Luoga stressed the accommodative monetary policy introduced that led to a fall in interest rates and a pick up in the growth of credit to the private sector, while being consistent to maintain low inflation close to the country’s medium-term target of 5%.

The report reminds that in 2018, the Tanzanian economy sustained high growth momentum and diversified with real GDP growth of 7.0% against 6.8% in 2017.

However, these figures are not consistent with the data released by the World Bank that estimated a GDP growth of 5.2% in 2018.

According to BOT, economic growth was driven mostly by investment in social and physical infrastructure, agriculture, manufacturing, and trade. The fastest-growing activities were agriculture, construction, and transport.

Meantime, fiscal policy was on track, with improved revenue collection and rationalized expenditure focused on available resources and priorities.

The external sector of the economy was faced with global challenges of the trade war between the US and China, geopolitical tensions in some regions of the world, and policy uncertainties in advanced economies. These challenges led to a decrease in demand for crop exports (particularly cotton), low return on foreign exchange reserves and an increase in petroleum products.

Looking ahead, BOT’s monetary policy will continue to focus on maintaining low inflation, ensure the stability of the exchange rate, and respond to economic conditions and policies in an endeavor to sustain the growth of the economy.

The Bank will also improve the functioning of the financial sector, among other intended outcomes, to reduce credit interest rates and improve lending to the private sector. This includes measures to improve payment systems in the process of digitization of the economy, as well as spearheading financial inclusion initiatives and development of financial markets